I wouldn’t exactly call DeFi the wild west of finance, but it’s hard to argue with the fact that DeFi activities come with significant risks. It is not without reason that we read about hacked smart contracts, crashed stablecoins or robbed custodians almost every day. Labeling DeFi as a failure because of such risks would still be wrong. Let’s not forget that DeFi summer was only two years ago. So DeFi is still in its infancy and needs some time to get the risks, user experience etc. under control (keyword: DeFi 2.0). “That’s all well and good… but it’s cold consolation if I lose all my coins to a hacker today!” you’re probably saying now. Worry not! In this post I introduce you to the decentralized insurer Unslashed Finance, which you can use to insure yourself against (almost every) evil that lurks in the crypto world.

Key facts about the insurance category

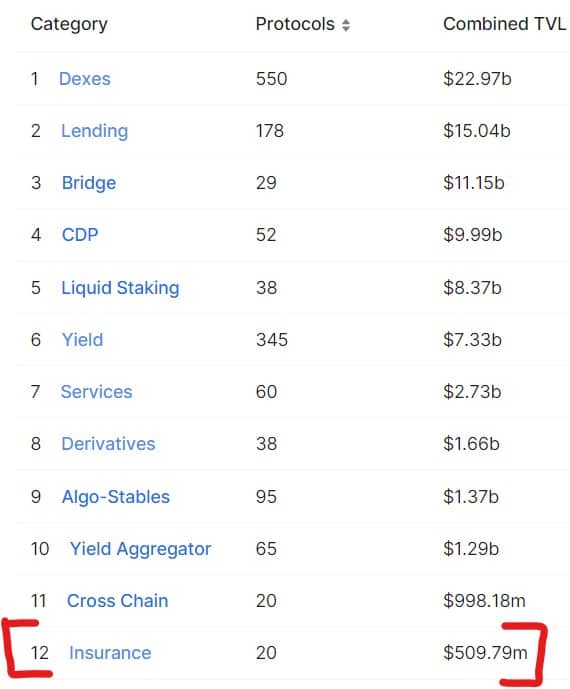

Despite the considerable risks that the journey through the DeFi world entails, the insurance category is (still) heavily underrepresented in the crypto ecosystem. If we take a look at Defi Llama then we see that the insurance category only ranks 12th among the 27 DeFi categories with a Total Value Locked (TVL) of a good half a billion US dollars and 20 insurance projects. In my opinion, this category still has strong upward potential… and could possibly be a good mid-term investment case?!

Key facts about Unslashed Finance

If we now look at the TVL ranking within the insurance category, we see that Unslashed Finance is “only” in 3rd place and that there are two larger insurance protocols accordingly. Nevertheless, I would like to go into Unslashed Finance in this post because I think it takes a super exciting approach to decentralizing claims processing. But more on that later.

Unslashed Finance was only launched last year (i.e., in 2021) by a team from London and is currently working with the second protocol version (v2). Like almost all DeFi protocols, Unslashed Finance has also created its own governance token for decentralized control of protocol parameters etc., the USF token.

It is also important to understand that Unslashed Finance was only rolled out on the Ethereum chain, but that basically says nothing about which risk events from which chains can be protected by the protocol. E.g., via Unslashed Finance you can not only hedge smart contract risks from Ethereum but from many different chains.

But which risks can you specifically hedge with Unslashed Finance?

- DApp / smart contract risk: The risk that the smart contract of a DeFi project will be hacked and you will lose your coins as a result.

- Oracle risk: The risk of an oracle providing incorrect price information to a DeFi protocol.

- Stablecoin de-peg: The risk that the stablecoin you hold loses the 1:1 rate to the underlying (e.g. USD).

- PoS validator slashing: The risk that your coins entrusted to a proof-of-stake validator will be destroyed as a penalty, for example because the validator was offline for a certain period of time.

- Central exchange hack: The risk of the central exchange that manages your coins being hacked.

- Central custodian hack: The risk of the central custodian managing your coins being hacked.

- Wallet hack: The risk that your software or hardware wallet is hacked.

The big picture

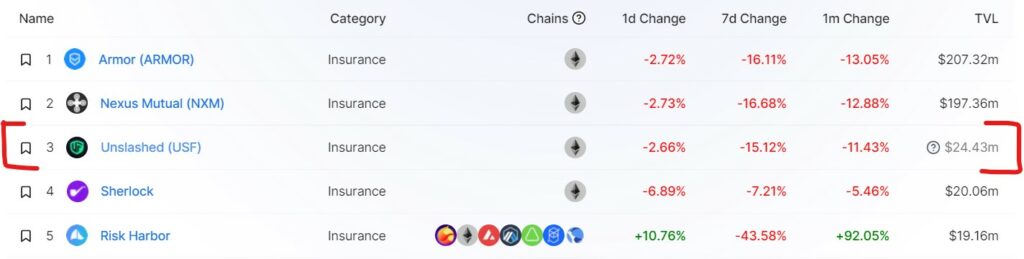

Next, let’s see how Unslash Finance actually works:

At the center of the protocol are the capital pools, which contain the capital with which the insured are compensated for their losses in case of a risk event. There is a separate capital pool for each insurable risk event. The capital pools are filled with ETH by liquidity providers (i.e., the insurers) (1). Everyone can contribute their ETH (or fractions of it … there are no minimum amounts) as liquidity. However, the liquidity providers do not contribute their ETH out of pure joy, but they do so in exchange for financial rights, which are documented in the form of capital tokens (CTKN) (2). As with every TradFi insurance company, the insurers’ accumulated capital is not simply left idle in the DeFi world, but the capital is rather invested as profitably as possible. However, Unslashed Finance does not do this itself, but uses the decentralized asset management services of Enzyme Finance (3). The insurance premiums to be paid per risk category are calculated by Unslashed Finance based on different risk factors (4). If a DeFi user now wants to insure himself against a specific risk event, he selects the corresponding capital pool and pays the required insurance premium in ETH into this capital pool (5). The insurance thus purchased is valid until the pool’s next rollover date and is documented for the policyholder in the form of premium tokens (PTKN) (6). The liquidity providers (i.e., the owners of the CTKN tokens) receive their share of the premiums paid and the profit generated on the capital by Enzyme Finance (7). If I understand correctly, the owners of the Governance Tokens USF do not currently receive any profit distributions (8).

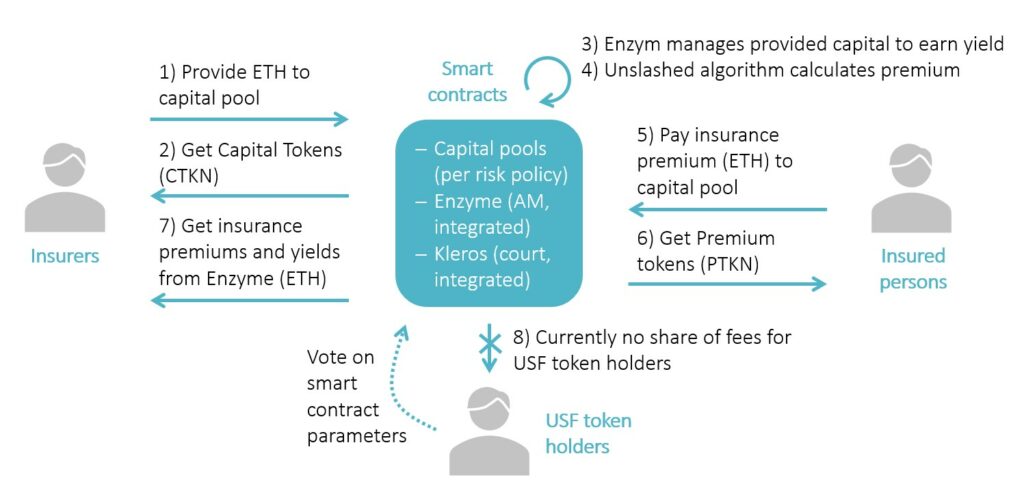

So far so good. But how does the claims processing work? How should a decentralized decision be made as to whether, for example, a specific smart contract hack is covered by a specific insurance policy or not? You can’t do that in a decentralized way… it needs a central organization that checks the applications and decides on the payment of the sum insured, doesn’t it!? But… it can be decentralized! Let’s examine Unslashed Finance’s decentralized claims processing:

At the beginning there is a risk event, which triggers a loss for an insured person (1). The insured (i.e., the PTKN owner) now requests the Unslashed Finance smart contract to pay out the corresponding sum insured to cover his loss. The insured must submit to his claim the evidence proving that he actually suffered the said loss (2). If no one reacts within a certain period of time (e.g., two days), then the Unslashed Finance smart contract automatically pays out the insured sum to the insured. Within this period of two days, however, everyone has the opportunity to critically examine the evidence submitted by the insured person and to challenge the claim if, in their opinion, the claim is not covered by the paid insurance (3). And now comes the crucial point: In the event of a challenge, the claim is forwarded to the Kleros Court for a definitive decision. Kleros is a decentralized decision-making service independent of Unslashed Finance. Kleros now randomly selects a subset of jurors from its pool of jurors, which makes a majority decision as to whether the claim is justified or not (4). The judges have a financial interest in telling the truth because if their verdict is in line with the majority verdict, then they are rewarded with tokens. If not, then tokens are taken from them (5). The challenger experiences the same thing: Depending on the decision of the Kleros Court, he is rewarded with tokens or tokens are taken away from him (6). In the event of a positive decision, the insured person is ultimately paid the sum insured (7).

User journey 1: Protect yourself against crypto risks

Now let’s see how you can actually take out insurance with Unslashed Finance.

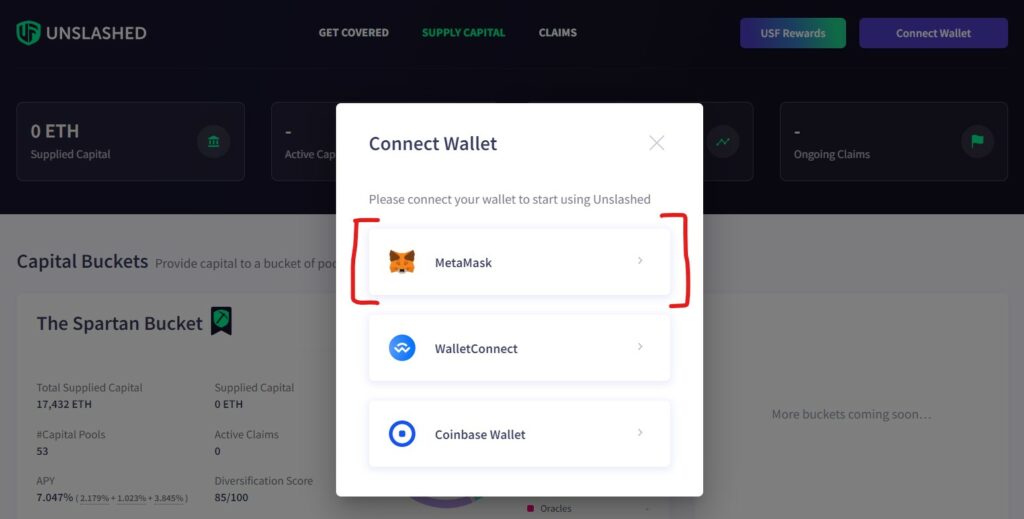

Step 1: First, open the Unslashed Finance user interface via app.unslashed.finance in your browser and clickConnect Wallet.

Step 2: As always in my examples, I choose my MetaMask wallet to connect.

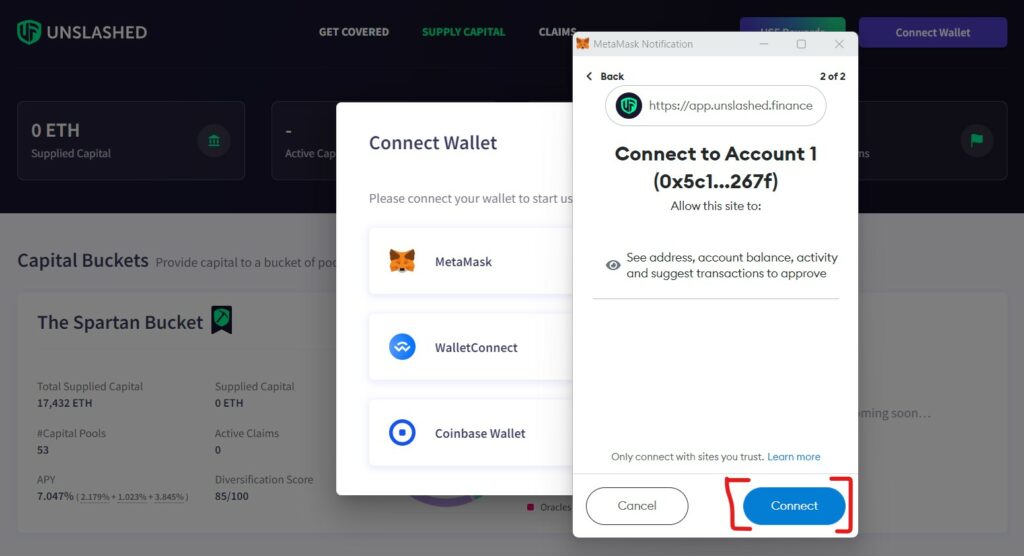

Step 3: Now allow Unslashed Finance to connect with your wallet.

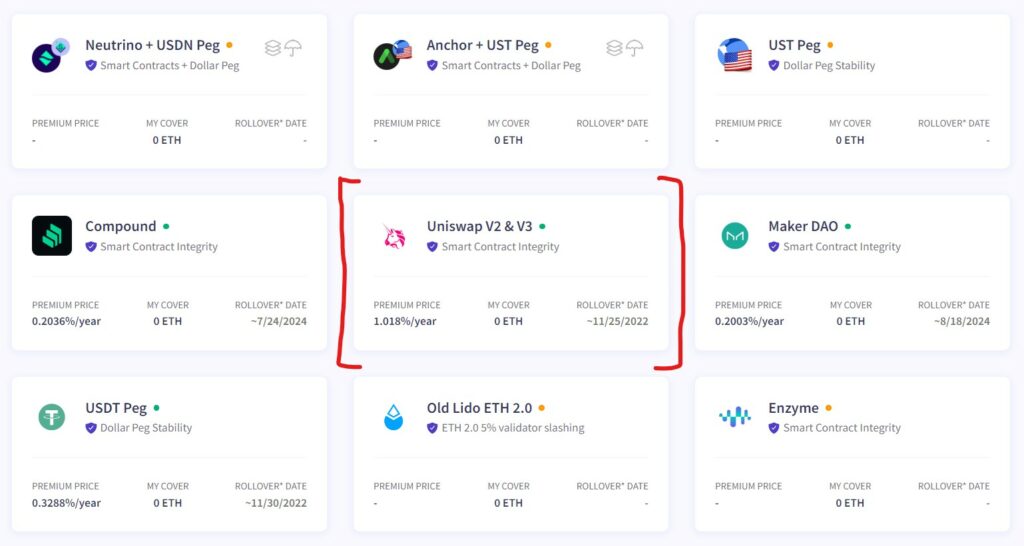

Step 4: Now let’s assume that we have invested in a liquidity pool of the decentralized exchange Uniswap (see here my blog post on Uniswap) and we want to cover ourselves in case someone hacks Uniswap’s smart contract and steals our tokens. For this we now click GET COVERED and scroll down until we find smart contract integrity cover for Uniswap and click on it.

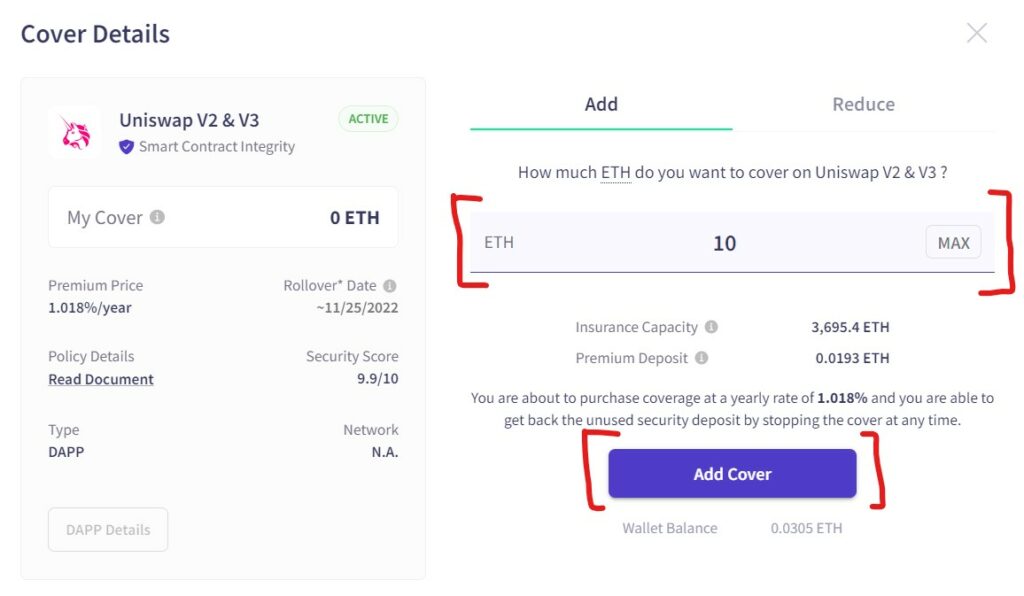

Step 5: We now see that Uniswap smart contract insurance costs a premium of 1.018% per year. We also see a link to the insurance policy, which describes the scope of the insurance in detail. We now enter 10 ETH as the insurance sum, assuming that we have invested a corresponding equivalent value in Uniswap and want to hedge this investment. Unslashed Finance now tells us that insuring this sum will cost us a premium of 0.0193 ETH for an insurance period until the next rollover date (November 25, 2022). Since the ETH amount on my wallet is greater than this premium, the Add Cover button is active and I finalize the transaction and confirm it on my MetaMask wallet. By the way: We can cancel our insurance at any time, even before November 25th, and we will then get back the part of the insurance premium that has not yet been claimed.

User journey 2: Act as an insurer yourself and collect premiums

Now let’s take a quick look at how we can present ourselves as an insurer to earn passive income in the form of insurance premiums.

Step 1: As described in user journey 1 above, we open app.unslashed.finance and connect our MetaMask wallet.

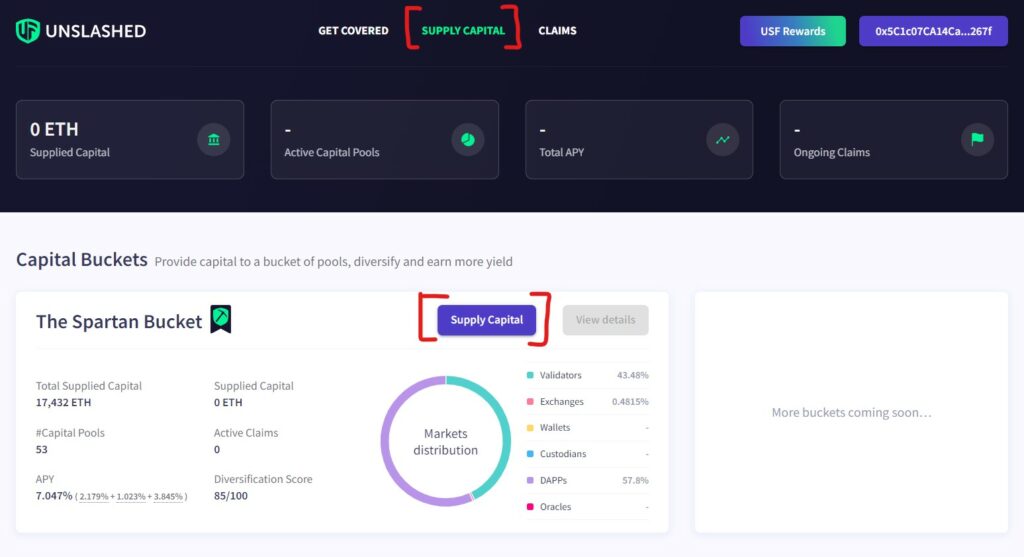

Step 2: We are now navigating to SUPPLY CAPITAL and select the Spartan Bucket. The Unslashed Finance bucket concept works as follows: Instead of investing in a single capital pool as a liquidity provider and thus having a lump risk, we can make our liquidity available to a bucket that distributes our invested amount across many capital pools (in the case of the Spartan bucket via 53 capital pools). As an insurer, we have thus diversified our risk and we have invested our capital more efficiently (i.e., we earn more). As you can see in the screen below, the Spartan Bucket is currently offering a return of 7,047% per year.

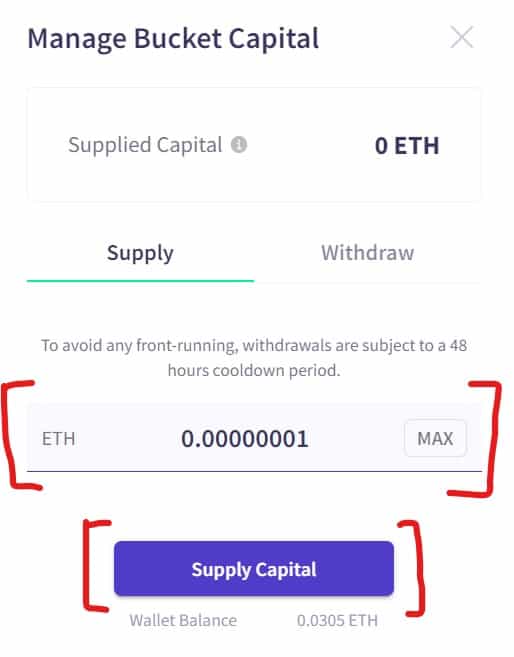

Step 3: In the next step we can now enter the ETH amount that we want to invest in the bucket. As you can see in the screen below, there are no minimum amounts. We could invest a mini amount of just 0.00000001 ETH here, i.e. a fraction of a cent. But please note: we are on Ethereum and the transaction costs (i.e., gas fees) on this chain are currently several USD. This means that even if it is technically possible to invest a fraction of a cent in Unslashed Finance, it does not make sense (at the moment) because of the relatively high transaction costs of Ethereum. That means we should probably have at least a few hundred US dollars in hand.

So, we have come to the end of this post. I hope you were able to take something with you for your DeFi backpack and maybe you will thank me one day when your favorite protocol is hacked and you are compensated for your losses by Unslashed Finance.

And by the way: In Module 7: Deep dive decentralized insurance of my DeFi course “Fit for DeFi” I’ll show you in a video how you can use Unslashed Finance most easily. Take a look at the video!