Welcome to our Aave guide where you’ll learn everything you need to know about the legendary lending protocol Aave and how you can best use it for yourself.

What is Aave?

Aave is a decentralized liquidity market protocol where users participate as lenders or borrowers. Lenders provide liquidity to the market by depositing their tokens into Aave’s liquidity pools, for which they receive interest. Borrowers take loans by tapping into these liquidity pools, for which they pay interest.

Aave loans are perpetual (i.e., without predefined maturity dates) and based on over-collateralization (i.e., loans have to be smaller than provided collaterals).

Where does Aave come from?

Finnish entrepreneur and programmer Stani Kulechov founded the platform in 2017. The platform initially operated under the name ETHLend and raised $16.2 million during its ICO (Initial Coin Offering) round. At that time, the team behind ETHLend pursued a peer-to-peer lending model and offered their service on Ethereum only.

In 2018, they switched to a peer-to-contract lending model based on liquidity pools. At the same time, they underwent a rebranding to become Aave, which means “ghost” in Finnish. This transformation culminated in the launch of the $AAVE token in 2020, which serves as the governance token for the Aave DAO (Decentralized Autonomous Organization).

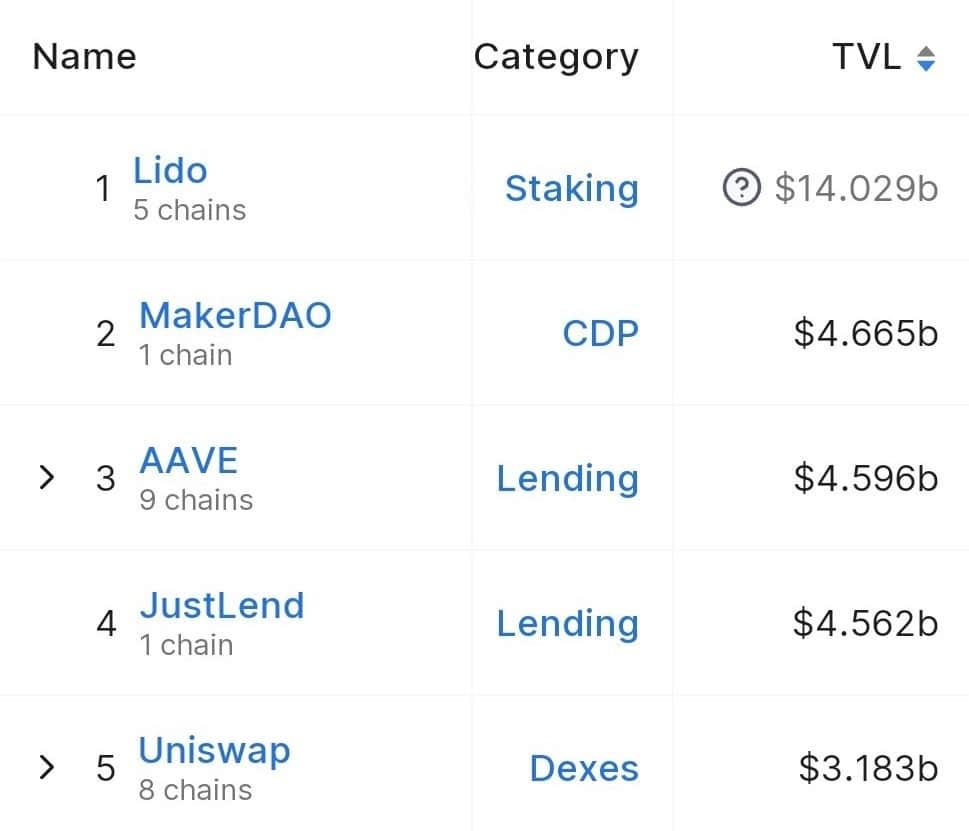

How big is Aave today?

At the time of writing, Aave has a TVL (Total Value Locked = value of all tokens deposited in the protocol by liquidity providers) of $4.6b according to DefiLlama. This makes Aave the biggest protocol within the lending category and the third-biggest protocol across all DeFi categories.

Today, Aave allows users to lend and borrow 21 different cryptocurrencies across nine different chains: Ethereum, Polygon, Avalanche, Arbitrum, Optimism, Metis, Base, Fantom, and Harmony. But it’s important to note that the majority of Aave’s TVL – currently 86% – is still with Ethereum.

How much is a loan?

As a borrower, you can choose between variable and stable rates. Variable rates are based on the current supply and demand in Aave. Stable rates are fixed in the short term but can be adjusted in the long term as a result of changing market conditions.

On Ethereum, borrowers currently pay a variable APY (Annual Percentage Yield) of 0.34-14.17% depending on the tokens they borrow. As an example, borrowing USDC stablecoins costs 3.55%. Check out the Aave markets for the latest rates.

How much can I earn?

On Ethereum, as a supplier, you currently earn an APY of 0.01-4.83% depending on the tokens you supply. For example, for USDC stablecoins you get 2.86%.

But why do lenders earn smaller rates than the rates paid by borrowers? One reason is that the protocol does not forward all interest paid by borrowers to the lenders. Instead, it pays a share of the interest to the Aave ecosystem treasury. The other reason is that not all tokens supplied by lenders are utilized by borrowers. For example, for USDC, the utilization rate is currently 90%. This means that lenders’ rates would have to be smaller than 90% of borrowers’ rates even if Aave ecosystem treasury would not get a share.

What is the AAVE token?

Aave’s governance token AAVE serves as the focal point for protocol governance. As an AAVE token holder, you can vote on accepted collaterals, interest rates, risk parameters, etc., or make suggestions yourself.

Plus, as an AAVE token holder, you can earn a passive income via staking. To stake your AAVE tokens, you have to deposit them in Aave’s so-called Safety Module. The Safety Module serves as an additional security for lenders in case of a disaster such as a smart contract failure. In return for this insurance, the Aave stakers receive staking rewards.

Here is the latest market data for the AAVE token provided by CoinGecko:

How does Aave work?

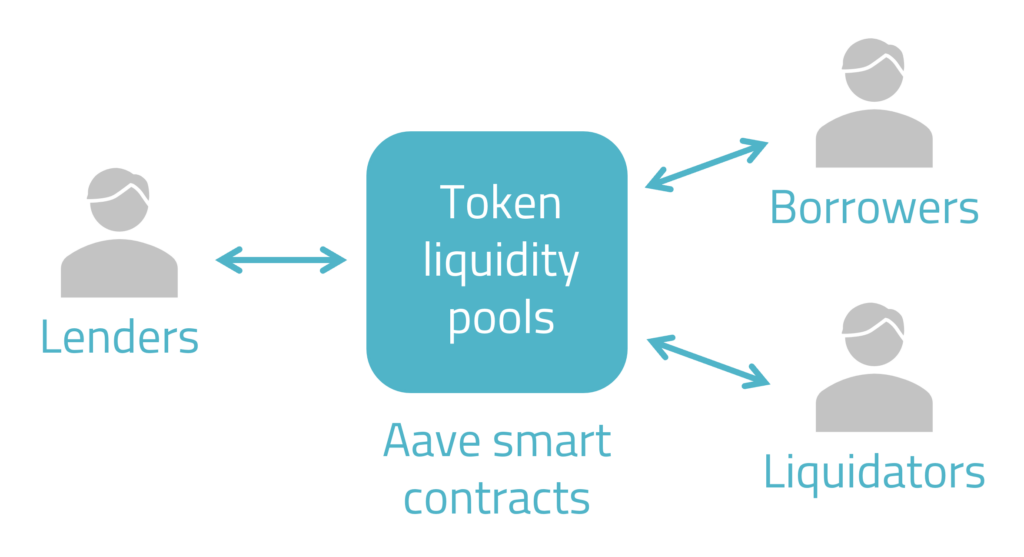

To understand how Aave works, let’s have a look at the Aave smart contracts and how the different user groups – lenders, borrowers, and liquidators – interact with them.

- Aave smart contracts – DeFi services are based on smart contracts, pieces of self-executing code that run on a blockchain. In the case of Aave, these smart contracts manage liquidity pools, into which lenders deposit tokens, so others can borrow them.

- Lenders – Lenders provide liquidity to the pools, for which they earn interest. When lenders deposit tokens, the Aave smart contracts mint them so-called aTokens at a 1:1 ratio. For example, when you deposit 1 ETH into the Aave ETH pool, you receive 1 aETH in return. Over time, as the pool generates interest and grows, your aETH token balance will increase beyond the initial 1 aETH. You can later redeem your aETH for the underlying ETH at a 1:1 ratio.

- Borrowers – Borrowers borrow tokens from the pools in an over-collateralized manner. Over-collateralization means that the value of the provided collateral has to exceed the value of the borrowed tokens. In this context, the term Maximum Loan To Value (Max LTV) is used to describe the maximum borrowing power of a specific collateral. For example, ETH has a Max LTV of 80.5%, which means that if you provide 1 ETH as collateral you can borrow up to 0.805 ETH worth of another cryptocurrency.

- Liquidators – Liquidators identify under-collateralized positions and trigger liquidations to maintain the health of the overall system. A borrow position is considered under-collateralized and subject to liquidation if its LTV rises above the liquidation threshold of the collateral. For example, ETH has a liquidation threshold of 83%. In the event of a liquidation, liquidators step in to repay up to 50% of the outstanding loan on behalf of the borrower. In return, they are allowed to purchase the collateral at a reduced price from the borrower and keep the discount (or liquidation penalty) as a reward.

What are the risks with Aave?

No protocol can be considered entirely risk-free. The risks related to Aave are amongst others the following (non-exhaustive list):

- Liquidation risk: In the event of a substantial decline in the value of your collateral, your borrowing position might get liquidated and you have to pay a liquidation penalty.

- Smart contract risk: This is the risk of a bug within the protocol code that allows a hacker to steal your supplied tokens.

Step-by-step guide to supplying and earning

For this step-by-step Aave guide, let’s assume you want to supply 10 MATIC to Aave’s Polygon market (MATIC is Polygon’s native token similar to ETH being Ethereum’s native token).

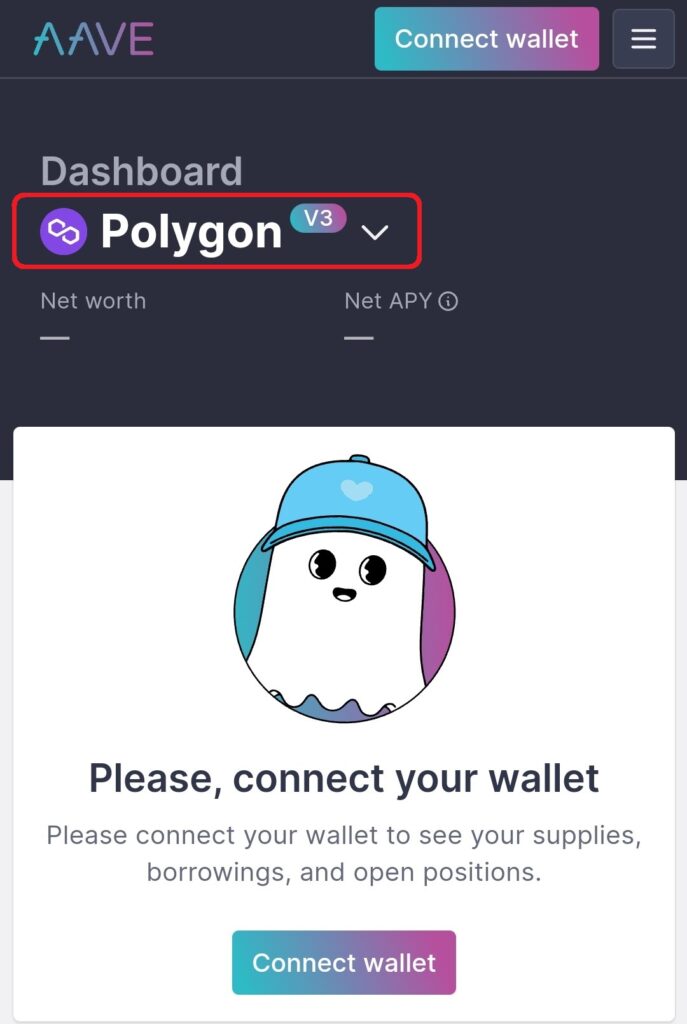

Step 1 – Go to app.aave.com and select the Polygon chain.

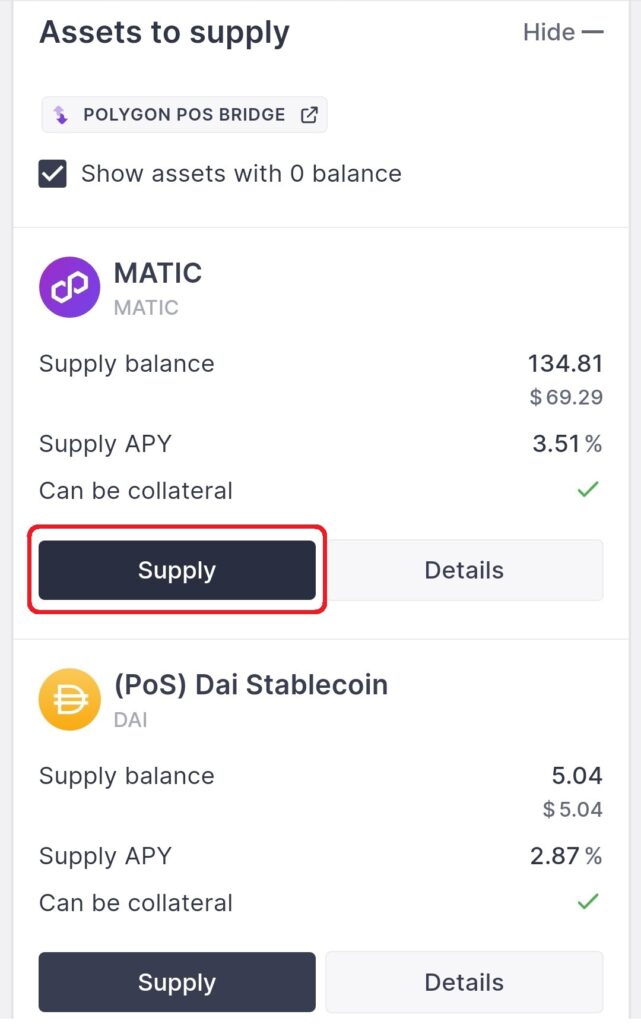

Step 2 – After connecting your wallet (e.g., MetaMask), you see a list of tokens you can supply including their APY. Click the Supply button for MATIC to go for the 3.51% APY of MATIC.

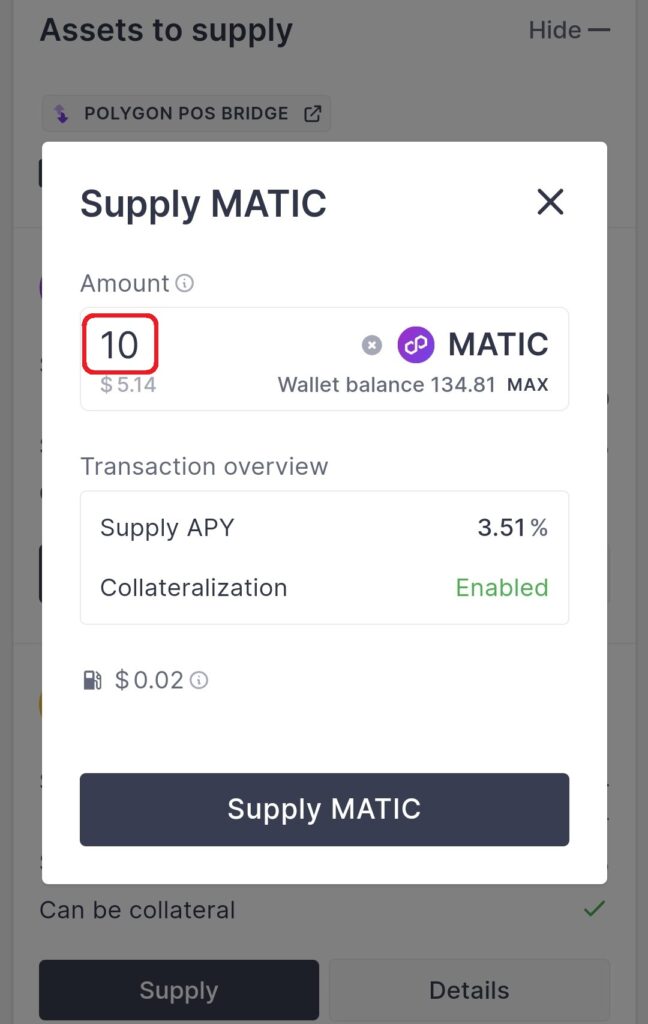

Step 3 – Next, input 10 MATIC in the amount field. After checking the gas fees for the transaction (it’s only $0.02), click the Supply MATIC button.

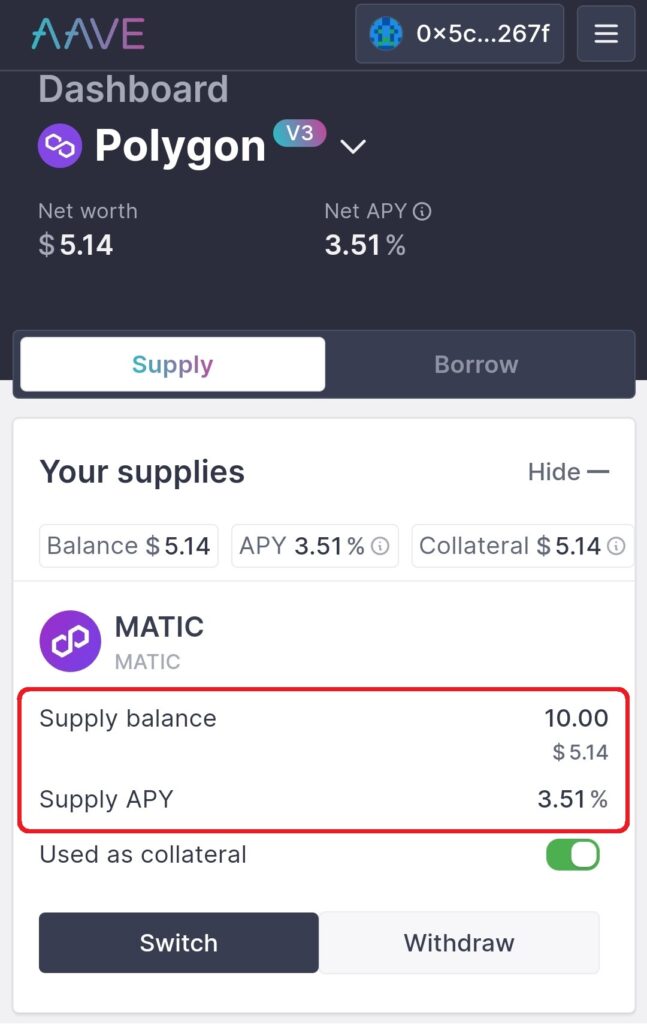

Step 4 – After confirming the transaction with your wallet, the transaction is settled on-chain and you can see that your supply balance is now 10 MATIC for which you are earning 3.51% from now on.

Step-by-step guide to borrowing

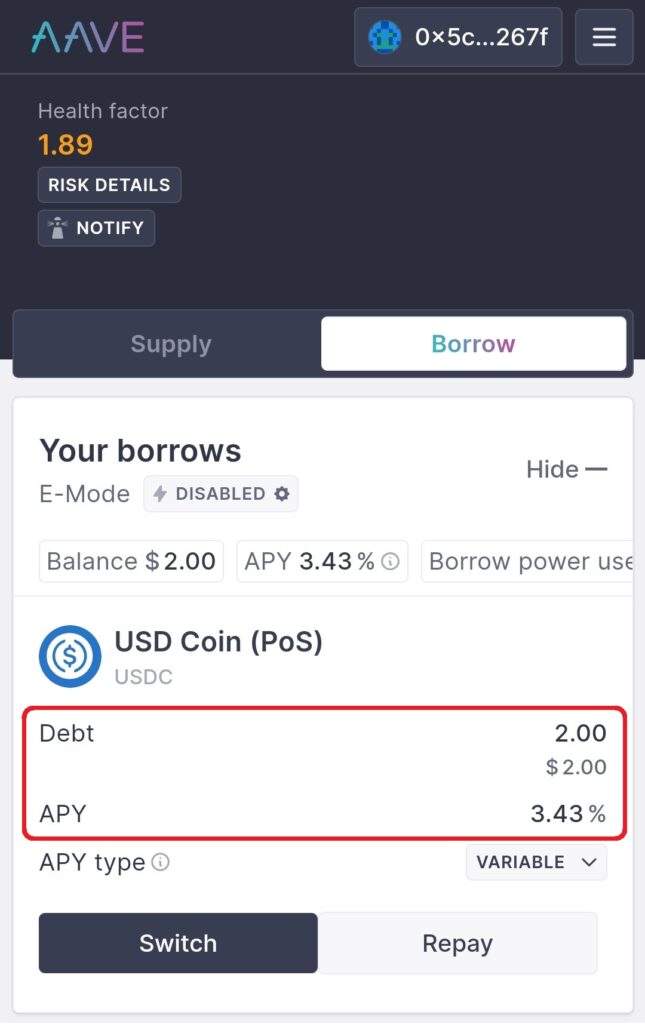

For our next step-by-step Aave guide, let’s assume you have supplied 10 MATIC to Aave and want to use them now as collateral to borrow 2 USDC (USD-pegged stablecoin USD Coin).

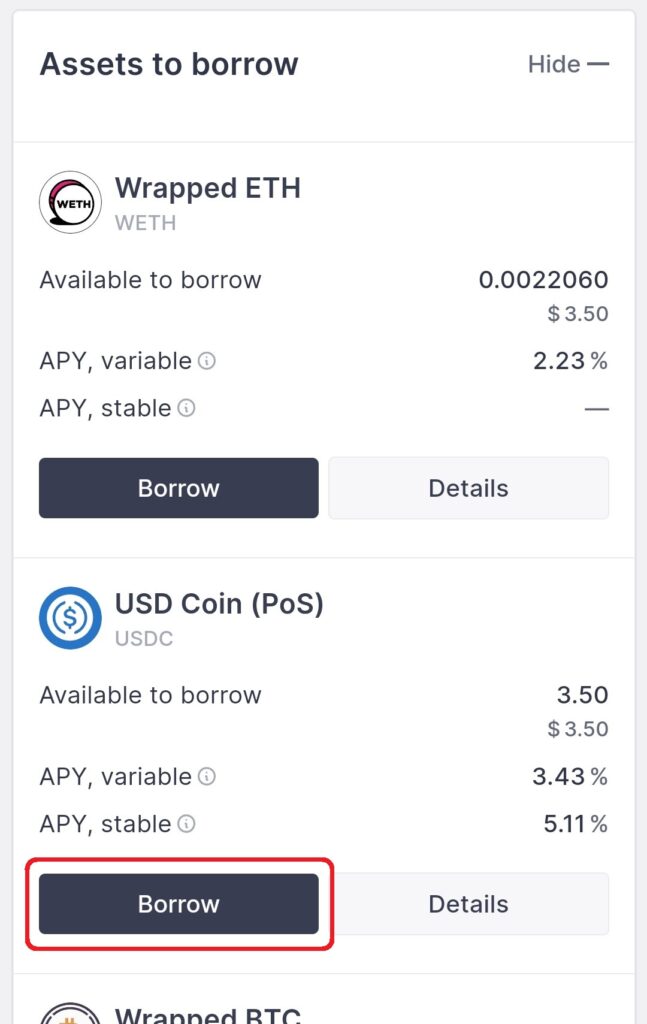

Step 1 – Go to app.aave.com and head to the borrow tab to see a list of tokens you can borrow including their variable and stable APY. Click the Borrow button for USD Coin to borrow USDC at a variable rate of 3.43%.

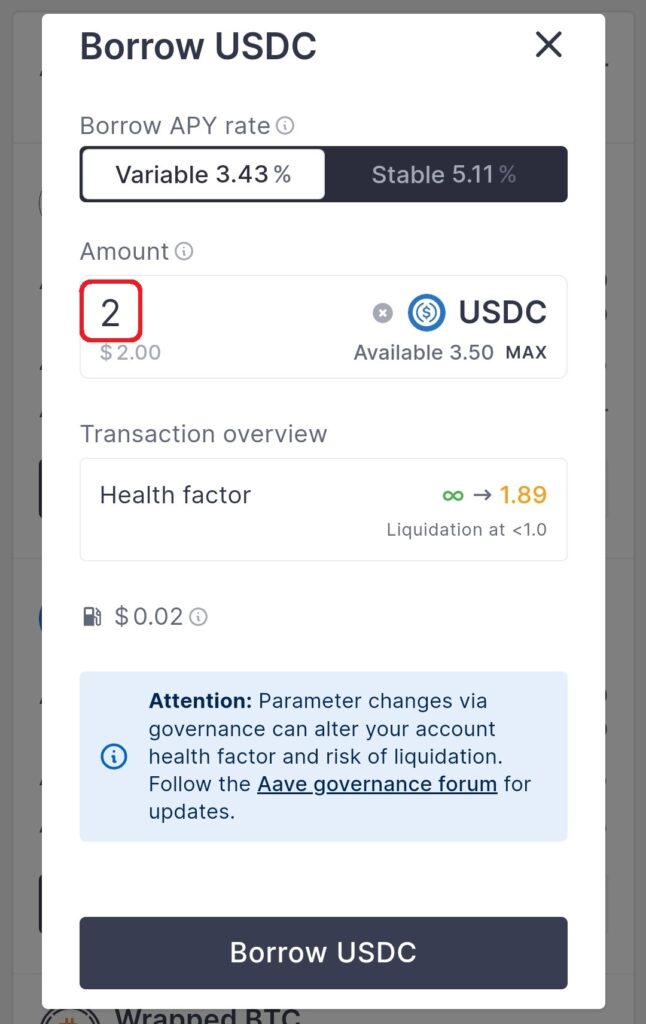

Step 2 – Next, input 2 USDC in the amount field. After checking the gas fees for the transaction (it’s only $0.02), click the Borrow USDC button.

Step 3 – After confirming the transaction with your wallet, the transaction is settled on-chain and you can see that your borrow balance is now 2 USDC for which you are paying 3.43% from now on.

Continue your journey…

Thank you for reading our Aave guide to the end. To continue your Aave journey we recommend the following next steps:

- 🔑 Set up your MetaMask wallet

- 🚀 Try the Aave app yourself

- 📖 Check out the Aave document hub

- 📫 Get notified about new guides

This Aave guide is for general information only and does not constitute financial advice. Always do your own research before investing. See also our disclaimer.