Staking and yield farming are two common ways to generate passive income in the DeFi world, which is typically significantly higher than current near-zero interest rates in TradFi. While the two options look pretty similar at first glance – both staking and yield farming are basically about making your tokens available to a third party for a fee – at second glance it quickly becomes clear that the two approaches work completely differently and therefore entail different risks.

In this blog post, let’s take a look at how staking and yield farming work and what the key differences between these two investment opportunities are.

What is staking?

When people talk about staking, they usually mean PoS (=Proof of Stake) staking. This is where the term originally comes from. However, it is important to know that in addition to PoS staking there is also DeFi protocol staking and that this staking alternative can also offer interesting returns.

Let’s take a closer look at the two staking variants!

PoS staking

PoS stands for Proof of Stake and PoS staking refers to the process by which users deposit their tokens as collateral to support a PoS blockchain and receive a reward in the form of native tokens of that blockchain. In the Ethereum context, this means that users deposit their ETH tokens as collateral to support the Ethereum blockchain and receive a reward in ETH.

The background to this is that a PoS blockchain works differently than a PoW (Proof of Work) blockchain, such as Bitcoin. With a PoS blockchain, the network is not secured by solving complex mathematical riddles, but by using so-called stakes, i.e. stakes that the participants deposit in the form of the respective cryptocurrency.

The participants select a validator at regular intervals, who is allowed to confirm the next block of transactions on the blockchain and receives a reward for doing so. The probability of being selected depends on the amount of the deposited stake. In addition, the participants lose part or even all of the staked tokens in the event of misconduct (e.g. when trying to manipulate the blockchain or if the participant is offline). This gives participants a financial incentive to be honest and play by the rules of the blockchain and therefore protecting the network from manipulation.

In addition, when staking, the so-called unstaking period (also called lock-up period) must be observed, during which you have to wait until you can freely use your tokens for other purposes again.

In summary, you expose yourself to the following two risks with PoS staking (there are also the usual DeFi risks such as smart contract risk, custody risk, regulatory risk, etc., about which you find in our introduction to DeFi more information):

- Risk of slashing: If you make mistakes when staking (intentionally or unintentionally) or if you are not online for whatever reason and are therefore not available as a validator, then your staked tokens will be taken away from you, which is called slashing in technical jargon.

- Price risk due to lock-up: You are also exposing yourself to an increased price risk because you cannot react to price fluctuations due to the lock-up period. You cannot react when prices fall sharply because you have to wait until the lock-up period is over.

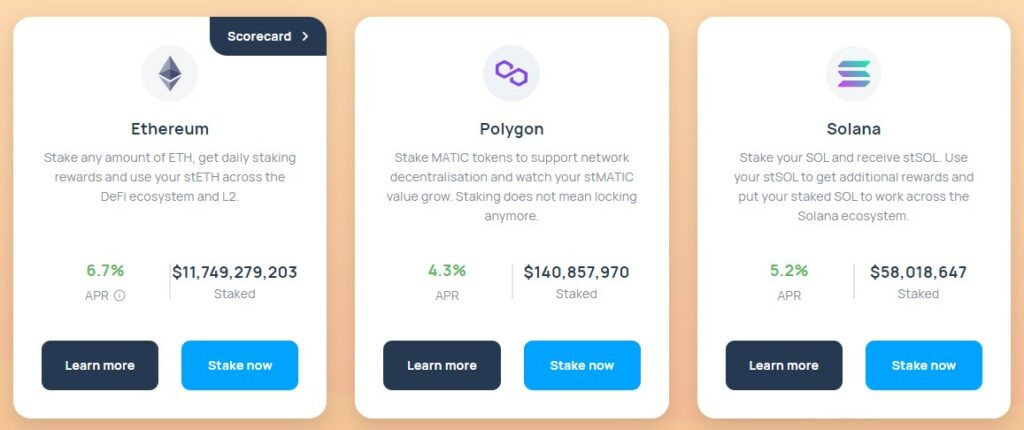

Fortunately, there are different ways to mitigate these two risks. For example, you can insure yourself against the risk of slashing with insurance protocols such as Unslashed Finance (you find more information about this in our guide to Unslashed Finance). Or you can avoid the price risk as a result of the lock-up period by investing in so-called liquid staking. Liquid staking is simply the same as PoS staking except that your staking position is a liquid derivative; i.e., you can sell your tokenized staking position at any time or use it in other DeFi protocols, e.g. for leverage. By the way, the most common protocol for liquid staking is Lido (learn more about Lido in our guide to Lido).

And here are the current interest rates, which you can generate by staking via Lido on the big chains Ethereum, Polygon and Solana. Not bad, those interest rates between 4.3% and 6.7%, right? But the critical reader will probably counter that not only the interest rates count, but also the performance of the invested tokens (in the three examples below ETH, MATIC and SOL). This is of course absolutely correct!

DeFi protocol staking

Just like with PoS staking, you also deposit your tokens with DeFi protocol staking and you can only freely dispose of your tokens again after an unstaking or lock-up period. This means that your tokens are also blocked for a certain period of time.

With DeFi protocol staking, however, you do not deposit your tokens to participate in the consensus mechanism of a PoS blockchain, but you deposit your tokens in a specific DeFi protocol that runs on a (PoS or PoW) blockchain. And this specific DeFi protocol typically does not give you native tokens of the blockchain in return, but native tokens of the DeFi protocol and sometimes additional special voting rights.

But why should a DeFi protocol have an interest in you depositing your native protocol tokens for a fixed period of time? I see the following three use cases here:

- Controlling the token quantity and thus the token price: For example, if you deposit your native protocol tokens with the protocol for a fixed period of one year, your tokens will not be tradable for a period of one year. This reduces the supply of the token on the market, which has a (temporary) price-increasing effect. And for that price-boosting effect, the treasury of the protocol is willing to pay you appropriate compensation.

- Long-term protocol governance: A slightly different use case was first applied by the decentralized exchange Curve and has the background that many DeFi protocols are struggling with the short-term interests of their governance token holders. In fact, most native tokens give their holders the right to vote on changes to the protocol. Therefore, these native tokens are also called governance tokens. Now the problem is that many of these governance token holders have very short investment horizons and therefore mostly vote to optimize their short-term profit and not the long-term success of the protocol. To counteract this, Curve’s treasury introduced the so-called vote-escrowed token veCRV. In concrete terms, this means that the holders of the native Curve token CRV have no voting rights. You will only receive voting rights if you stake your CRV tokens for a fixed period and receive veCRV in return (the longer you lock away your CRV tokens, the more veCRV you will receive). This means that Curve now has governance token holders who have staked their CRV tokens for a longer period of time and therefore have to take a longer-term investment horizon into account when voting. And as compensation for this longer-term staking of the CRV tokens, veCRV owners receive passive income from Curve treasury.

- Additional security for the DeFi protocol: We see a completely different case for DeFi protocol staking using the example of the lending protocol Aave. The fact is that while holders of the native token AAVE have voting rights, they do not receive a share of the interest that borrowers pay to the protocol. In order to receive interest as an AAVE token holder, you must first stake your AAVE tokens into the so-called Aave Safety Module, which gives you stkAAVE tokens. As a stkAAVE token holder, you then have both voting rights and the right to parts of the interest generated. But you don’t get these rights for free, because the Aave Safety Module (including your staked AAVE tokens) serves as additional security in case Aave has a shortfall in outstanding credit. This means that you may not get back all of the Aave tokens you deposited if there is a shortage. For more details on how Aave works, see our blog post about Aave.

So as you can see, the risks of DeFi protocol staking depend very much on which DeFi protocol you choose. For example, you should take a close look at how Aave works in general and the Aave Safely Module in particular before you decide to stake a larger amount in the Aave Safety Module.

What is yield farming?

As we have seen, the basic principle of staking is that you store your tokens in a protocol for a certain period of time and that nothing is done with your staked tokens during this period (unless your tokens are slashed during PoS staking or a part of the Aave Safety Module will be liquidated due to underfunding). So your tokens simply sit idle in a smart contract of a DeFi protocol and after this fixed period of time you will get your tokens back one to one.

In the case of yield farming, the situation is completely different. With yield farming, you act as a so-called liquidity provider for a DeFi protocol.

Let me give you some more background info here: DeFi protocols always need a liquidity pool in order to be able to offer their services to their users. For example, a decentralized exchange like Uniswap needs a liquidity pool of token A and token B in order to be able to exchange token A for token B for a user (see our guide to Uniswap). Or a decentralized lending app like Aave needs a liquidity pool of token A to be able to lend token A to a borrower (see our guide to Aave). And these token liquidity pools do not just appear out of thin air, but are made available by the so-called liquidity providers. And of course these liquidity providers want to be compensated financially for this, which is then called yield farming.

As you can see, in the case of yield farming, your tokens are used by the DeFi protocol to actively conduct transactions such as swapping or lending. It’s a bit like the traditional bank, which doesn’t just leave your account deposits lying around like they do with staking, but instead lends them to borrowers etc.

Accordingly, in contrast to staking, yield farming carries the risk that you will not get back the same tokens that you originally deposited. For example, with an exchange protocol like Uniswap, it can be the case that all your tokens A have been exchanged for token B by protocol users and you therefore ultimately no longer get your originally deposited token A but instead token B and this token B is now worth less than token A. This causes you to suffer a loss called Impermanent Loss (see our guide to Uniswap and Impermanent Loss).

This means that when doing yield farming, you should never just entrust your tokens to the DeFi protocol with the highest return. Here, too, it is important to understand the specific properties and risks of the respective protocol.

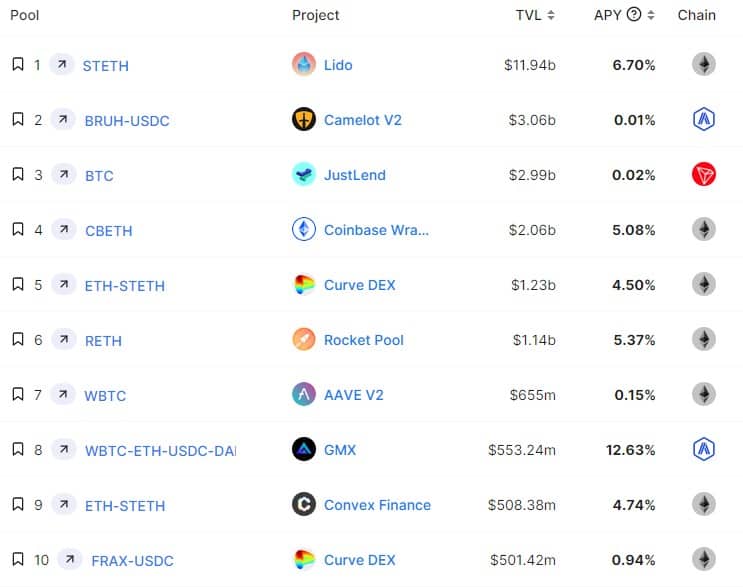

Finally, I would like to point out that chain analytics tools such as DefiLlama offer extensive lists with filter options for finding the most interesting staking or yield farming pools. Below is a screenshot of DefiLlama as an example. Such tools offer you an excellent introduction to the world of staking and yield farming. But don’t forget: These tools show you many interesting possibilities, a passive income far above the usual interest rates of the TradFi world, but “there is no such thing as a free lunch”; i.e., you absolutely have to understand the specific risks of the individual staking or yield farming solutions!