Regulation, regulation, regulation … is the order of the day in the crypto ecosystem. Gone are the days of the wild west, when crypto projects were primarily characterized by their influencers, but cared neither for their investors nor for the law. Switzerland is well prepared for this new age, having created a law for the legally secure issuance of tokens almost two years ago, the so-called DLT law. But what is the DLT law anyway, which applications have arisen from it and what can be expected in the future? Time for a quick overview.

Why is regulation important to me as an investor?

Since the FTX debacle, the saying “Not Your Keys, Not Your Coins” has been heard more often. Is regulation therefore superfluous as long as I only have the key?

The answer to that is a resounding no. First, there will always be situations where you as an investor are dependent on a trusted third party; switching from fiat to crypto requires a centralized crypto exchange, which will have control over your assets. Only regulation can ensure that the crypto exchange behaves correctly.

Secondly, being in control of your coins does not protect you from fraud: Just because you own a coin does not mean that the project initiators are not embezzling funds. In the past it often happened that the funds raised for a project were used for the luxurious lifestyle of the founders. According to the Cointelegraph the cumulative losses for all fraudulent ICOs amounted to over USD 10.12 billion. Here, too, only regulation that determines how the funds may be used can help.

After all, the saying “Not Your Keys, Not Your Coins” is a bit of an illusion. In the past, numerous projects had technical vulnerabilities, which were then shamelessly exploited by attackers. An example is the recent attack on Wormhole portal, where an attacker could steal USD 325 million. In order to protect yourself from attacks, you as an investor would theoretically have to carry out a comprehensive technical check of the project before making any investment (or try to get insurance e.g. via the decentralized Unslashed Finance protocol on Ethereum). But for most investors this is too cumbersome … or how often have you already done this in the past?

Regulation is therefore very relevant for you as an investor.

What is the DLT law?

Switzerland owes its leading role in the blockchain area to its regulation. Proper regulation was the main reason why Vitalik Buterin, founder of Ethereum, settled in Zug in 2014. This resulted in the entire ecosystem, which is now known internationally under the name Crypto Valley. However, that was nine years ago and blockchain has evolved. Because Switzerland wants to retain its leading position in the new age, it created the so-called DLT law. But let’s start from the beginning: What is the DLT law?

The DLT law is a new law that has been in force since the beginning of 2021. The content of the law can essentially be summarized in the following formula: security = token. Now what is a security? A security is a piece of paper that contains a specific right that the owner of the paper is entitled to. For example, a share certificate gives its holder the right to a dividend from the corporation. Thanks to the DLT law, everything that was previously a security can now also be issued as a token. In this way, a share certificate becomes a share token. This type of token is also known as a security token.

Sounds relatively unspectacular, but it isn’t: On the stock exchange alone, securities worth more than USD 250,000,000,000,000 (250 trillion) are being traded. With the DLT law, these securities can also be integrated into the blockchain ecosystem as tokens. At the same time, token holders now have clearly defined rights for the first time. Switzerland is the first major country to have such a law. In doing so, Switzerland has revolutionized nothing other than the depiction and transfer of securities.

Which projects are already using the DLT law?

The projects that use the DLT law can currently be divided into three groups:

1) Processes

This group includes all applications that try to make the existing financial market infrastructure more efficient using blockchain. Recently, for example, a consortium consisting of Credit Suisse, Pictet and Vontobel conducted a proof of concept for the issuance of an actively managed equity certificate and a structured bond. This security token was issued on a public Ethereum test blockchain and subsequent trading took place on BX Swiss, a Swiss exchange. The advantage of tokenization in this case is that the three operations of issuance, trading and settlement took place within hours, whereas previously it took several days.

The aim of this group of applications is to make existing processes more efficient. For you as an investor, this group has no direct relevance because these are internal processes at banks.

2) Infrastructure

This group includes all applications that replicate the current financial market infrastructure on the blockchain. The two Swiss crypto banks, namely Seba and Sygnum, are active in this area. These two banks are working on a comprehensive infrastructure for digital assets. For example, Seba has created a gold token based on Swiss law, which is an ERC-20 token. This gold token enables investors for the first time to own a digital form of physical gold through a fully regulated, low-cost and future-proof solution. The advantage of the gold token is that it can be redeemed at refineries at any time and there are no transport and storage fees. Because the gold token is backed with real gold, it can also be used as a stablecoin.

The Swiss stock exchange SIX has created the world’s first blockchain-based exchange SDX. Trading, processing and custody are based on distributed ledger technology. The SDX is licensed by the Swiss Financial Market Supervisory Authority and processed a digital bond for the first time last year. Because the DLT is only used for internal accounting, this application is not based on the DLT law.

The aim of this group of applications is to replicate existing infrastructures on the blockchain. For you as an investor, this group is only relevant if you can access it directly, which has rarely been the case up to now.

3) Innovation

Various fintechs are already in the process of using the DLT law for innovations. The aim is to create new types of financial products using blockchain. For example, Frigg.eco is a fintech in the field of sustainable finance. Sustainable infrastructure projects will play a key role in reducing greenhouse gas emissions in the future, but are currently underfunded. Obstacles are intermediaries who charge excessive fees and the costs of a stock exchange listing. Frigg.eco offers a solution with which sustainable infrastructure providers can easily refinance themselves via the crypto market and the bonds can be traded publicly at any time.

Another example is Crowdlitoken, where investors can invest in real estate from as little as CHF 100. Investors can purchase a certain number of tokens and then distribute them to various real estate projects according to their needs. At the end of the term, investors receive a repayment worth their entire portfolio. Crowdlitoken is based on Liechtenstein law, which has a law similar to that in Switzerland.

For you as an investor, this group has the highest relevance.

Has the DLT law lived up to expectations?

No. First of all, the number of applications is limited. Secondly, a large part of the previous investment products are niche products which are not of great relevance for the average investor. So far, the problem has been that many of the applications bring only incremental improvements. However, for the traditional financial world to move to the blockchain, significant improvements would be required. The question arises as to where these improvements could lie.

What does the future hold?

Especially in the course of the current FTX scandal, development is moving in the direction of Decentralized Finance (DeFi). Decentralized Finance refers to all applications that also exist on the traditional financial market, but do not require intermediaries. Instead of relying on trusted intermediaries, these applications rely on code.

Used correctly, DeFi brings the significant improvements required for a system change. Thanks to disintermediation and automation, financial products can be made accessible to a wider group of people. Today, private investors essentially only have access to financial products that are traded on a traditional stock exchange. Admission to the stock exchange is very expensive, however, because a large number of financial intermediaries are required for operation. For this reason, a large part of the financial products are not publicly traded, which means that private investors cannot invest in them either.

In contrast, DeFi’s decentralized exchanges work fully automatically, they are inexpensive and do not require any financial intermediaries. In this way, numerous financial products can be traded publicly for the first time and made accessible to a broader population group. Start-up shares can be given as an example. Currently, startup stocks are not publicly traded, so only the richest 3% of the population can invest in startups. Thanks to the DLT law, start-up shares can also be traded on decentralized stock exchanges for the first time, which means that everyone can invest in start-ups. This is just an example of other innovations to come.

What do I still have to watch out for as an investor?

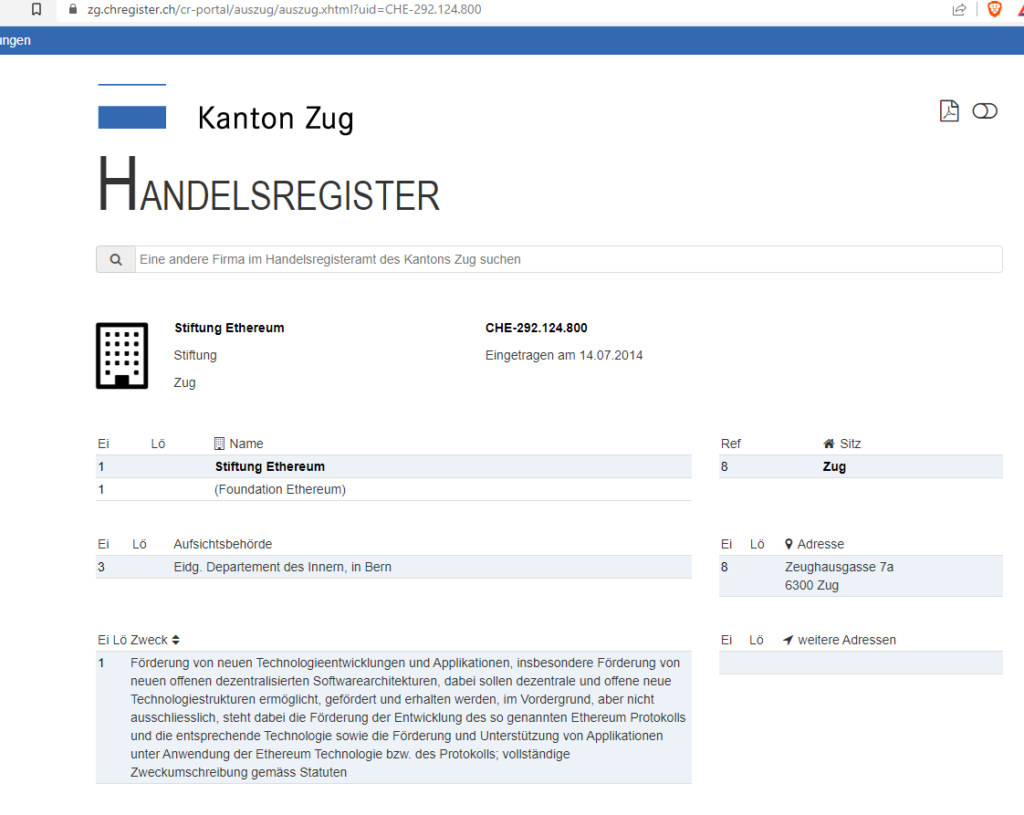

When investing in a crypto projects, the first thing that is important is that a provider exists at all and that it was established legally. Otherwise, you can’t hold anyone accountable. In Switzerland you can find this out in the commercial register. Even completely decentralized projects have to be programmed by people and are therefore usually registered, or should be (see Ethereum below).

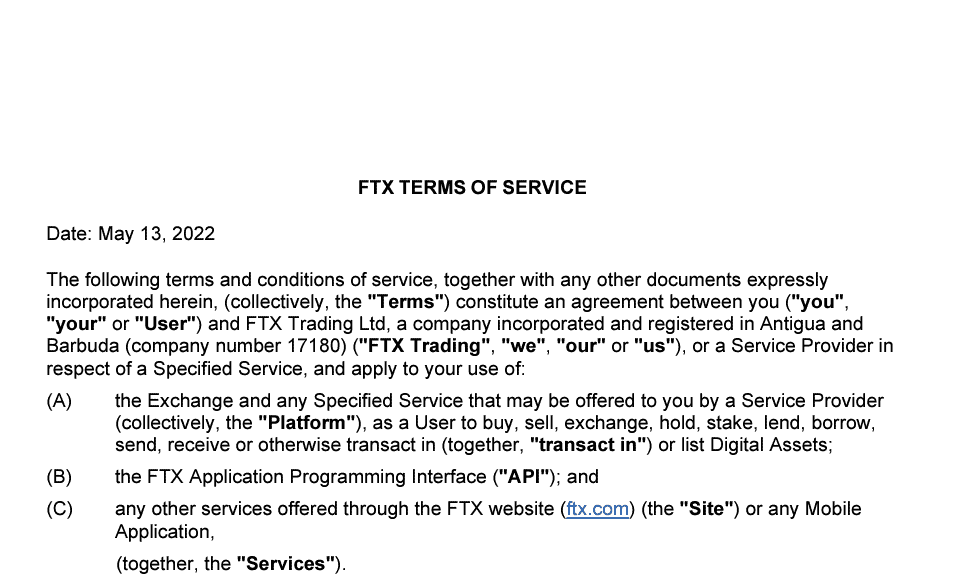

Second, you should pay attention to the country in which the provider is based. For example, FTX was based in the Caribbean, although the founder is from the United States. A warning sign, which was clearly stated in the Terms and Conditions (see below). If a project is based in an exotic country, at least question marks are appropriate. It is also worth taking a look at the applicable law and where an investor can sue.

But the most important thing is the quality of the project; it is of little use to you as an investor if a project has a clear legal basis but is an economic flop. Therefore, the most important thing in the future will be the added value a project generates for its customers. Only one thing can apply here: DYOR – Do Your Own Research.

Conclusion

Until now, the blockchain ecosystem was essentially limited to crypto projects, in which only a minority of the population was interested. Thanks to the DLT law, the blockchain can be used for any project, potentially increasing the number of users exponentially. The expectations of the DLT law were correspondingly high. Almost two years after the DLT law came into force, the initially high expectations have not been fulfilled. The reason is that most of the previous applications did not bring significant improvements compared to the existing system. Such significant improvements can potentially be found in the DeFi space, although the further journey remains to be seen.