Do you have a clean, long-term investment strategy for your cryptos in place and are you now holding your positions whether the market is going up or down? Congratulations, then you are one of the consistent HODLers (HODL = Hold On for Dear Life) and that is certainly not the dumbest approach! But are you one of those HODLers who leave their coins lying around in their wallets? If yes, then this article about staking with Lido on Ethereu and other chains is for you!

The nice thing about the DeFi world is that you have countless opportunities to “lend” your tokens to a wide variety of dApps (dApp = distributed application on the blockchain) and thus generate passive income without having to forego the upside potential of your tokens. For example, you can temporarily put your tokens in an Aave lending pool and generate interest income (look here for the Aave User Journey). Or you can provide your tokens to a DEX liquidity pool (DEX = decentralized exchange; e.g Uniswap) to act as a market maker on this exchange and thereby receive small fees for each trade (or swap) on the exchange (here you find our Uniswap guide). Or you can earn passive income by staking your tokens in a PoS blockchain. And it is precisely this last case that we want to look at here.

There are often misunderstandings about staking, partly due to the fact that there are basically two very different types of staking. So let’s briefly clarify the terminology:

- Staking at dApp level: You can add security to a dApp such as the lending and borrowing application Aave by depositing your tokens in the dApp’s security module. At Aave, for example, such a security module is used as security for the Aave users against loss by hackers: If Aave is hacked, then up to 30% of the deposits of the security module are used to cover the resulting losses of the users. This generates trust for the users… and passive income for you as the token staker of the security module… as long as no hack happens.

- Staking at blockchain consensus level: In the second case of staking, you do not contribute to the security of a dApp with your deposited tokens, but to the security of the blockchain itself. The background here is the blockchain consensus mechanism Proof of Stake (PoS), which has largely replaced the old consensus mechanism Proof of Work (PoW) (the most prominent exceptions is the Bitcoin blockchain). In short, Proof of Stake works as follows: In contrast to Bitcoin, PoS does not allow the miner to add the next block to the blockchain (and pocket the newly created coins and transaction fees) who solves a difficult mathematical puzzle with brute calculation power first, but the one who has deposited a certain amount of tokens (which is called “staking” in technical jargon) as a guarantee of their honesty and is selected at random. If that staker, randomly selected by the blockchain protocol, then adds the next block to the blockchain and it is accepted by the vast majority of other participants, then that staker gets back their collateral tokens plus a reward in the form of additional tokens. However, if the block proposed by the staker is not accepted by the others – for example because the staker is a crook and wanted to enrich himself by cheating – then the staker loses his tokens deposited as security (so-called “slashing”) and he gets nothing. This economic incentive ensures the correctness of the PoS blockchain.

In this article we now want to focus on the second type of staking – i.e. staking at the blockchain consensus level. The fact is that staking is not as easy as one might think because you often need dedicated hardware for this and your laptop can’t keep up. Furthermore, life is made difficult for you as a staker by not only losing your deposited collateral if you are dishonest, but also if you are offline with your computer.

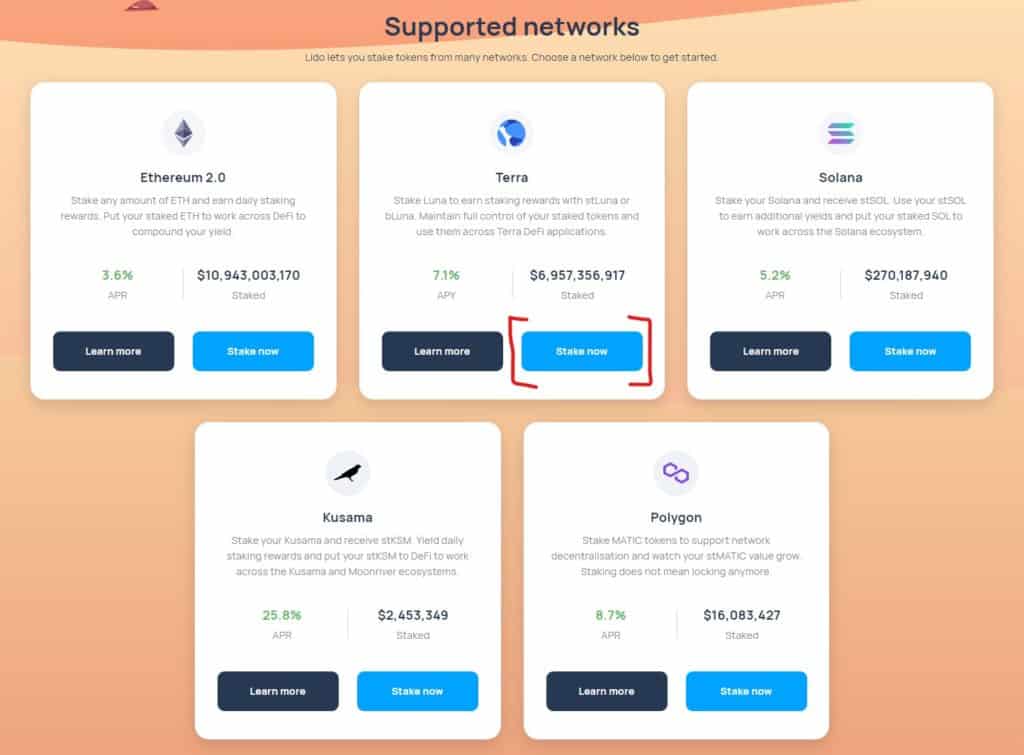

The easiest way to participate in staking is to use a DeFi service that does all the staking work for you and simply transfers the staking rewards (minus a small fee) to you. Welcome to Lido! With Lido you can easily stake your tokens on five different blockchains to generate a daily income: Terra, Solana, Kusama, Polygon and Ethereum.

Lido offers you the following (not insignificant) advantages:

- No minimum amounts: You can take part for as little as 1 cent (or much less). DeFi does not know any minimum amounts, as we are used to from the traditional financial world.

- Liquid staking: If you stack your tokens on Lido, you will receive a newly created “st-” token (e.g., stETH) in return. This can then in turn be used like a normal token (in the case of Ethereum like a normal ERC-20 standard token) in many other DeFi services such as the lending and borrowing protocol Aave. This means that you don’t lose your liquidity by staking; hence “Liquid Staking”!

- Security: Usually if you use staking services, then exactly one provider will do the staking for you. This puts you at risk because you are betting all the coins on one horse: If this provider is offline, then there is a slashing and you are losing parts of your coins. It works differently at Lido. No matter how small your stake is, your coins (or the coin pool) are always distributed to several staking providers (= validators), so that the risk of default is significantly reduced. And these validator roles are not just given out on the quiet. This is done via the Lido DAO (DAO = Decentralized Autonomous Organization) which means that all the Lido governance token holders will have to accept a new validator. In addition, the Lido smart contracts are set up in such a way that the validators never have access to your tokens themselves. Instead, the tokens are just delegated to them without them being able to run away with them. In addition, Lido smart contracts are checked by leading auditors.

Now enough explained … now we finally want to take a step-by-step look at the user journeys for staking and then for unstaking on Lido.

User journey 1: Staking

Step 1: We open Lido via lido.fi and select the blockchain we want to stake on. In the overview we see the various expected returns in APY (= Annual Percentage Yield) and existing staking volumes. Let’s stake on Terra today. The APY is significantly higher there at 7.1% than on Ethereum with 3.6% and the transaction costs are extremely low, so that we can play around with even the smallest amounts here.

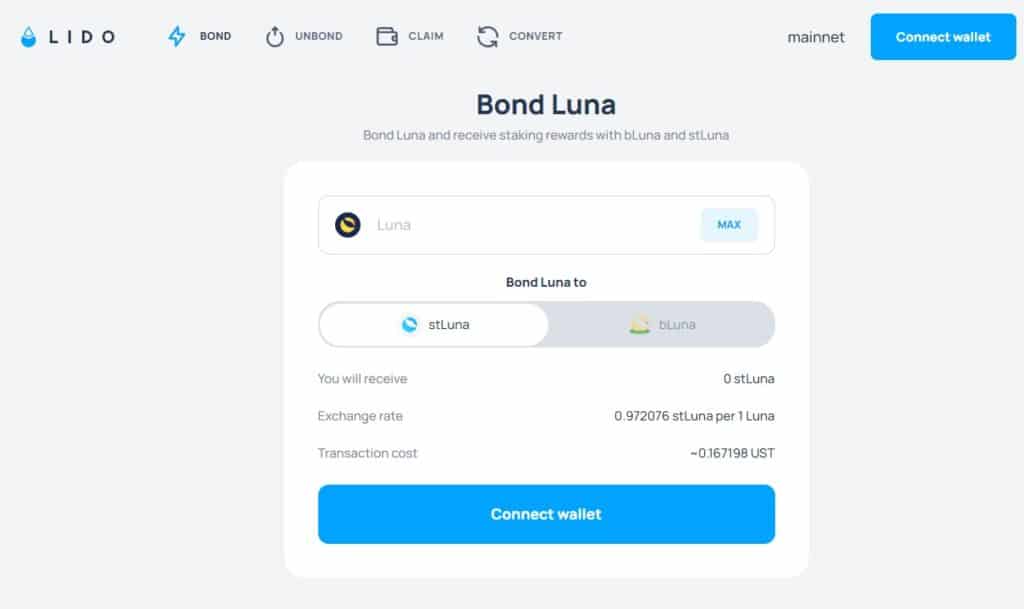

Step 2: Now the UI (User Interface) of the Lido dApp for Terra opens. As always with DeFi dApps, the first thing we have to do connect our wallet. Therefore we click Connect wallet.

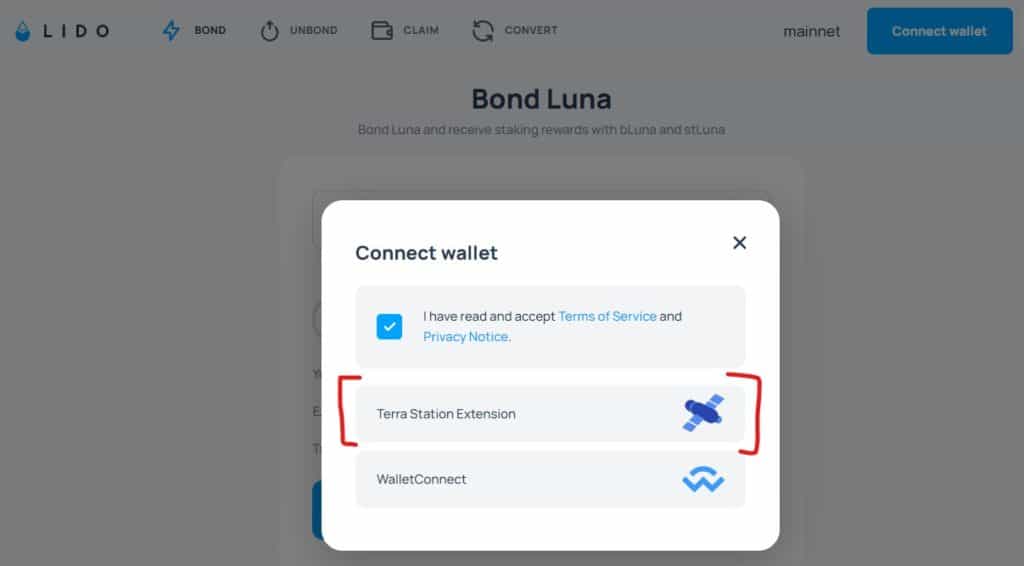

Step 3: Next we have the option to selecst our favorite wallet. We choose the Terra Station Extension, a small Chrome extension which you can download here.

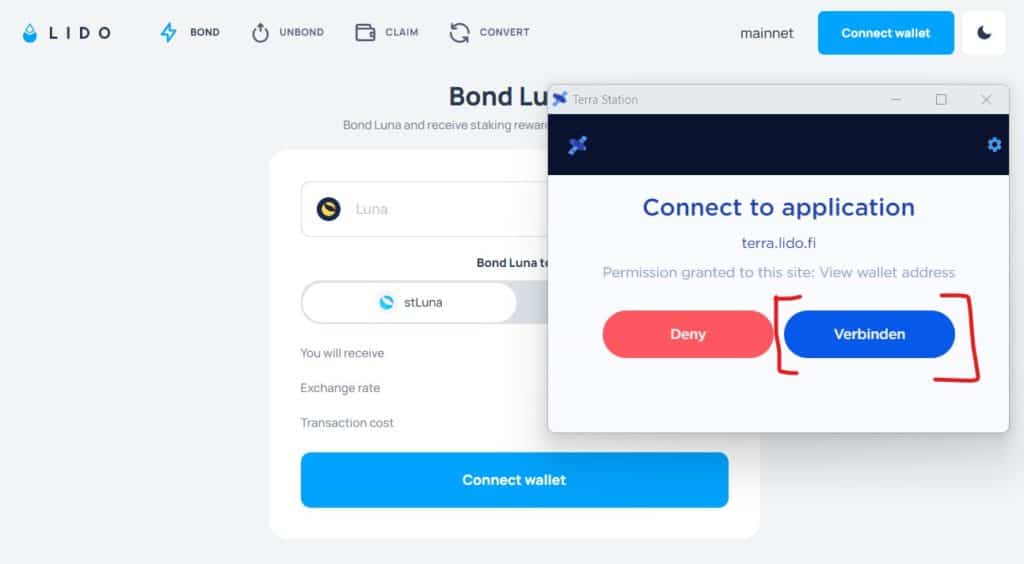

Step 4: The wallet now opens and we confirm the connectdion with the Lido dApp.

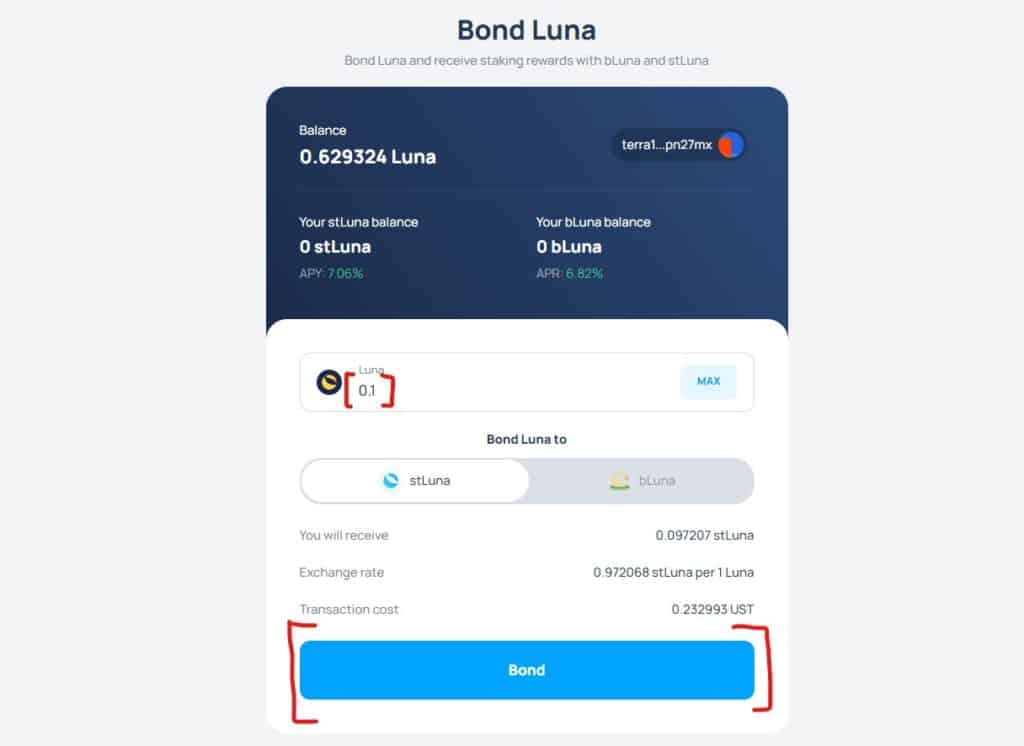

Step 5: Now we’re connected and ready for staking! Terra is staked with the native token Luna. We are careful and only stake 0.1 Luna. Then we click Bond, which means nothing other than to stake.

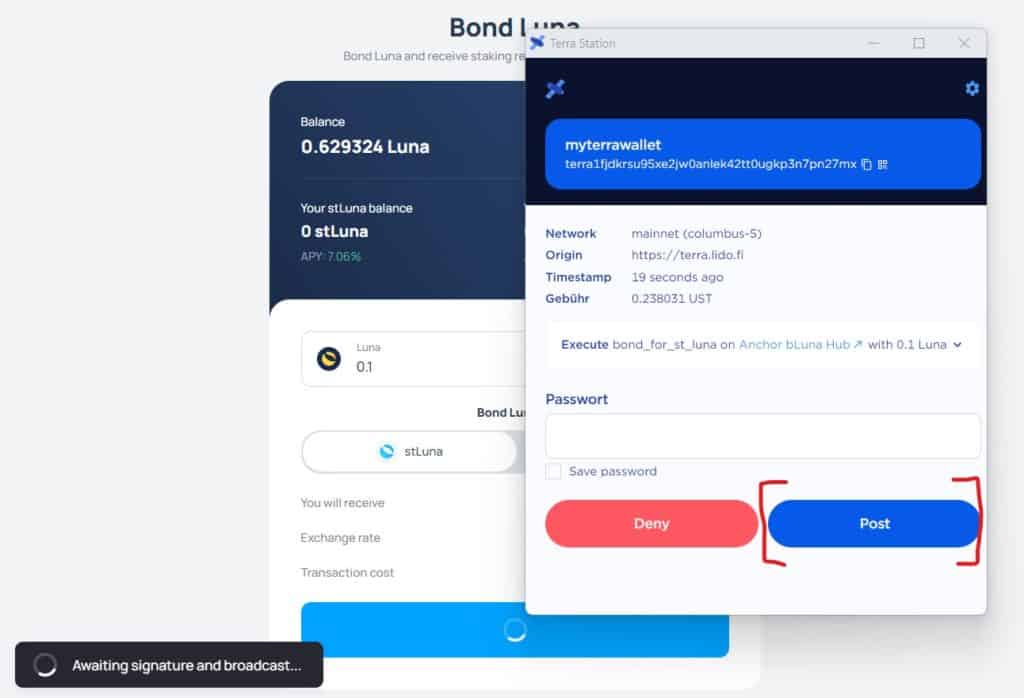

Step 6: As always, we have to sign the transaction with our wallet.

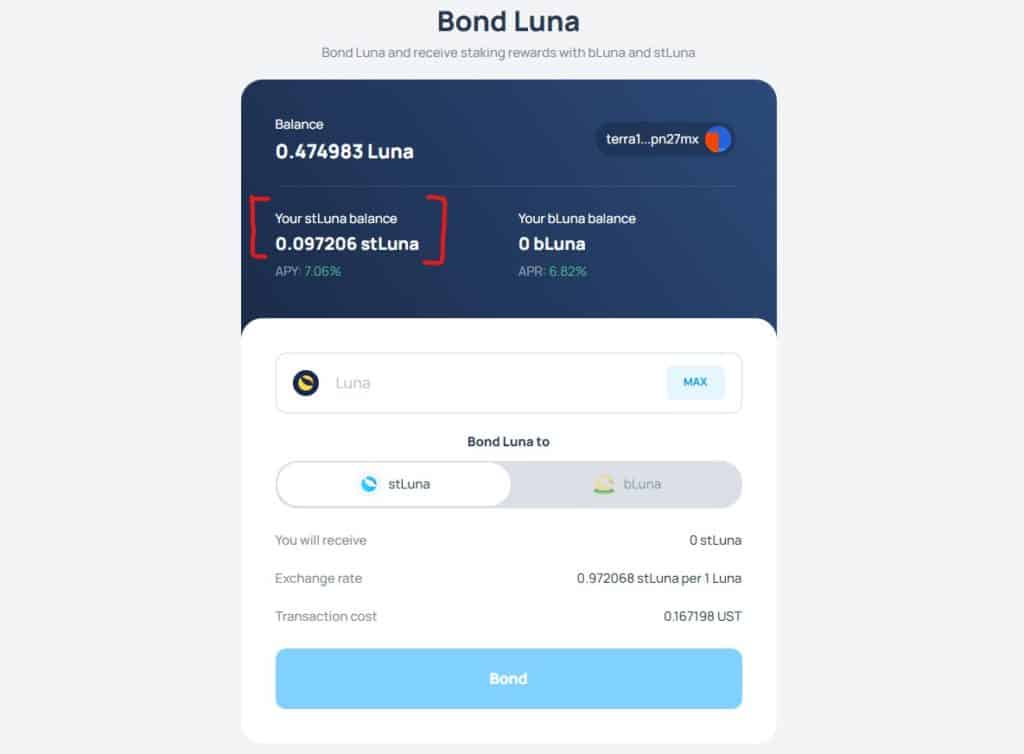

Step 7: Et Voila! As a result of our transaction, 0.1 Luna were now staked via the Lido protocol in the Terra consensus protocol and 0.097206 new stLuna (staked Luna) tokens were created and transferred to our wallet. This means that we are now likely to earn an annual percentage yield of 7,06% without doing anything. And we can now freely use the newly created stLuna tokens in other DeFi protocols if we want to.

User journey 2: Unstaking

Now let’s take a quick look at how we can get our staked tokens back.

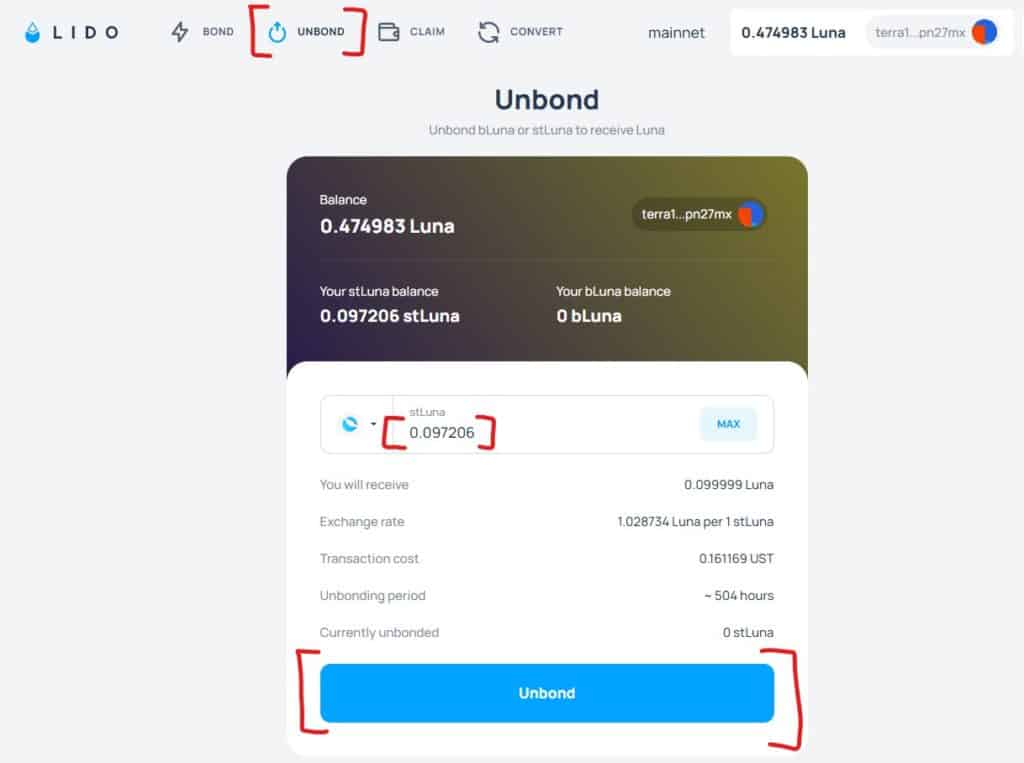

Step 1: As already described in User Journey 1, we open first lido.fi and we connect our wallet. Then we click UNBOND, because we don’t want to stake now, we want to unstake. We can now see in the UI that we have the 0.097206 stLuna tokens created in User Journey 1 available for unstaking. So now we click Unbond button at the bottom of the screen.

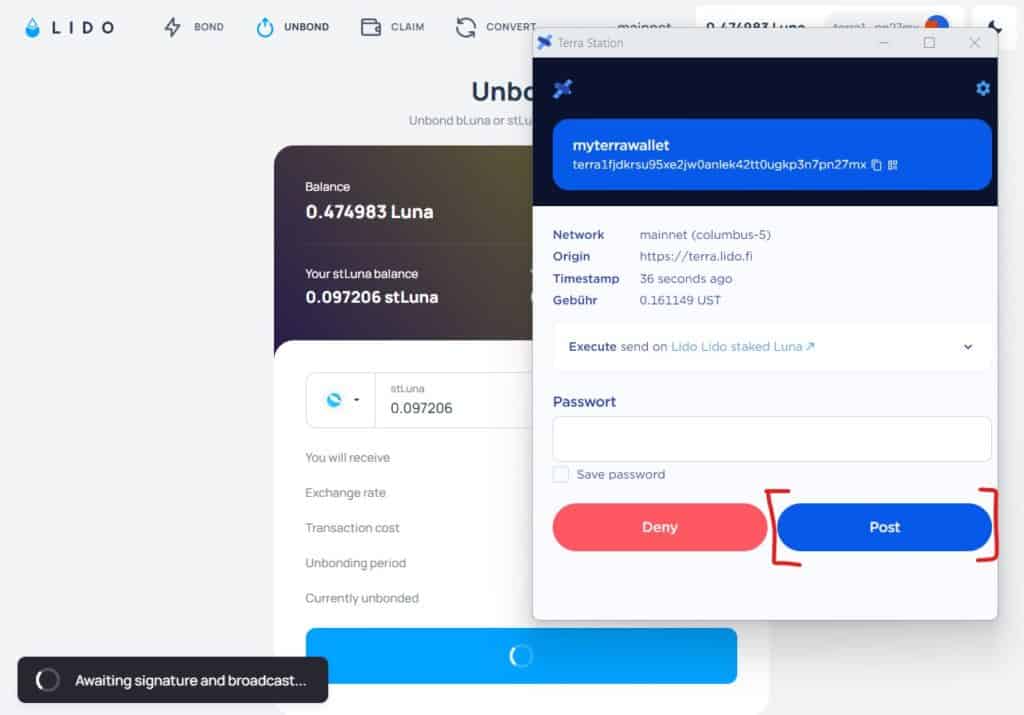

Step 2: As usual, we are now prompted to confirm the transaction in our wallet.

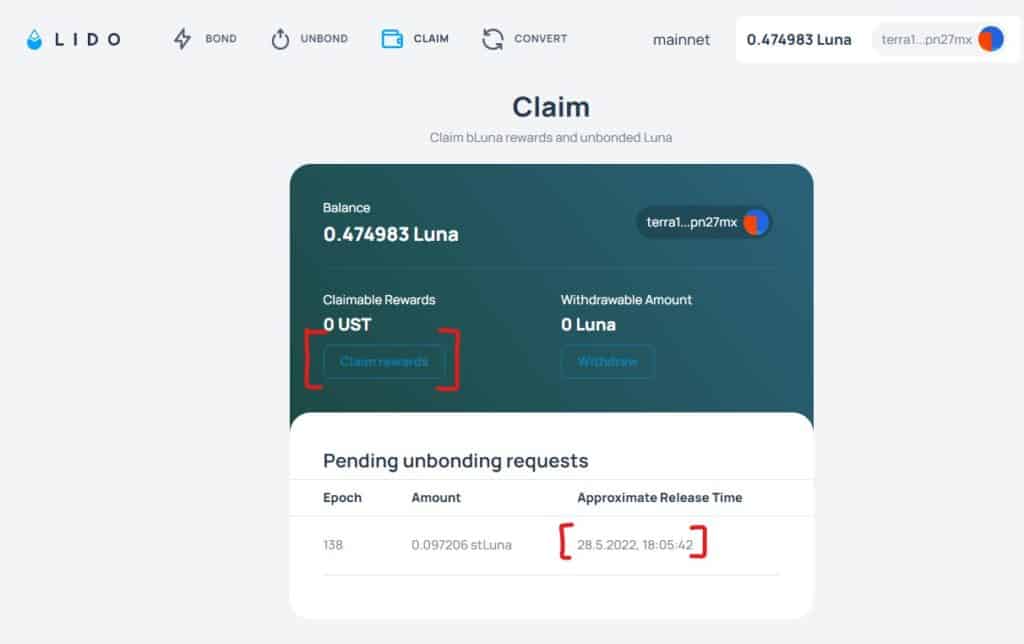

Step 3: Now we switch to the claim view to swap our unbonded stLLuna tokens back into Luna tokens. However, as we can see in the UI, we cannot swap the tokens immediately, but first have to wait a period of three weeks, which contributes to the security of the protocol. So we are now sitting for the three weeks… and then we can finally withdraw our tokens including the rewards received during the staking.

So, we have come to the end of this introduction to Lido. I hope it was fun and motivated you to try it yourself!