Dai is one of the first and largest stablecoins and occupies a very central position in the DeFi ecosystem. In this blog post I will first give you an introduction to Dai, MakerDAO and Maker Protocol and then show you the basic concepts behind the Dai stablecoin. Then I’ll show you step by step with screenshots how to generate your own Dai and use it to build up a credit position. Let’s get started!

What is Dai? What is the MakerDAO? What is the Maker Protocol?

That MakerProtocol is a smart contract-based lending platform on Ethereum that allows its users to create the stablecoin Dai (DAI), which has the goal of replicating the US dollar on a 1:1 ratio. Dai is a decentralized stablecoin that is not issued and (hopefully) collateralized by a centralized organization as is the case with the stablecoins USD Coin (USDC) or Tether (USDT). Instead, all issued Dai are backed by tokens deposited in the Maker Protocol’s Ethereum smart contracts (i.e., transparent to everyone!). In this context one speaks of a decentralized and collateralized stablecoin. All decisions related to the Maker Protocol are made by the MakerDAO (DAO = Decentralized Autonomous Organization) with the help of the MKR governance token.

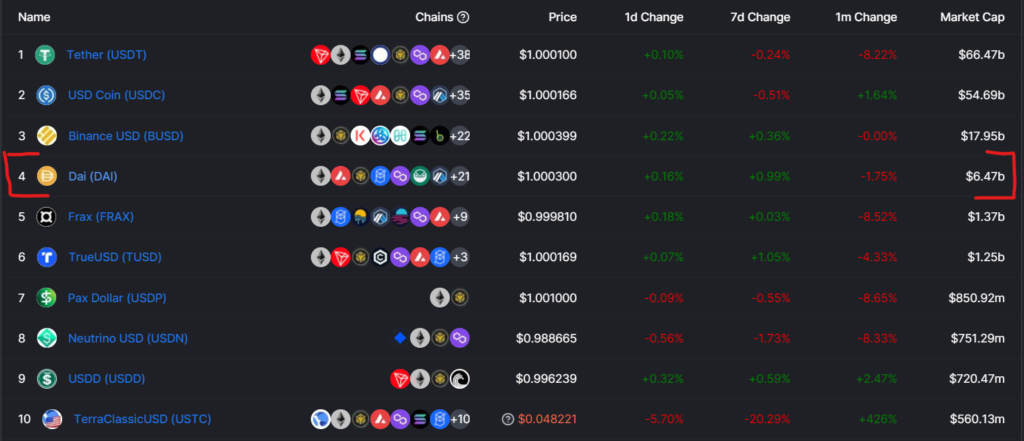

According to the information platform DefiLlama, Dai currently ranks 4th among the stablecoins in the DeFi ecosystem with a market capitalization of $6.47 billion.

How does the Maker Protocol work?

Anyone can use the Maker Protocol to create their own Dai by opening a Maker Vault (= a vault based on a smart contract on Ethereum), depositing collateral such as ETH or WBTC in the vault, and then generating Dai as a debt against that collateral. It is important to know that only those ERC-20 tokens are accepted as collateral that have been classified as suitable by the MakerDAO (i.e., as voted by the the MRK governance token holders). There are currently over 30 tokens accepted as collateral including the “classics” ETH and WBTC.

It should also be noted that, as usual for the DeFi world, a collateralization ratio of over 100% is required, which depends on the specific token (basic rule: the more volatile the token deposited as collateral, the higher the required collateralization ratio). For example, with a required collateralization ratio of 150%, the user can only withdraw up to 66% of the value of the deposited collateral in the form of Dai. The user must always keep an eye on this collateralization ratio, because if the value of the deposited collateral falls so low that the collateralization ratio is no longer guaranteed, the vault runs the risk of being liquidated, which entails a penalty fee of 13%. So-called keepers are responsible for the liquidation of undercollateralized vaults. These are mostly bots that monitor the system and trigger a liquidation as soon as they see a vault that doesn’t have enough collateral.

The credit received in the form of newly created Dai is not free, however, because a so-called stability fee – i.e. a kind of interest – has to be paid for it. This interest is due when the vault is closed (i.e. when the loaned Dai are repaid) and is to be paid in Dai like the loan amount itself. By the way: If the vault is dissolved by returning the borrowed Dai (and the user thus receives his deposited collateral back), then the returned Dai are withdrawn from the system and burned (i.e., destroyed).

And what role does the Maker Buffer play?

Imagine the situation where the crypto market collapses and the tokens deposited as security in the Maker Protocol lose a large part of their value within a very short time. What happens then? Then numerous vaults will probably fall below the minimum collateralization ratio and will be liquidated. However, if the market collapses too quickly, then it is conceivable that the proceeds generated in the liquidation of the collaterals cannot cover the outstanding Dai value. This means that the outstanding Dai are no longer fully secured… which would probably mean that the Dai would no longer be able to maintain the target price of USD 1. To counteract this event, the Maker Buffer was created. The Maker Buffer is accumulated with the stability fees, liquidation penalties etc. and comes into play when the proceeds from the liquidation cannot cover the value of the outstanding Dai. But what happens when the market has crashed so badly that not even the liquidity buffer can cover the difference? Then the Maker Protocol triggers a so-called debt auction, through which new MKR tokens are generated and sold. The proceeds from this are then used to cover the remaining difference. However, this action is not for free. Because creating more MKR tokens will dilute the value of the existing MKR tokens. Accordingly, the MKR holders are well advised not to take too many risks when making governance decisions, as otherwise they would have to pay for it indirectly through a dilution of their MKR tokens. And by the way: If the Maker Buffer is not used for a longer period of time and thus rises above a certain threshold, then the amount above the threshold is used to buy back and burn MKR tokens. This corresponds to an indirect distribution of revenue to the MKR token holders, as the remaining MKR tokens increase in value as their number is reduced.

How does the Savings Rate fit into the concept?

The Dai Savings Rate (DSR) allows any Dai holder to generate passive income by depositing their Dai into the Maker Protocol’s DSR smart contract. The level of the Dai Savings Rate is determined by the MKR token holders (i.e., the DAO) with the aim of supporting the peg to the US Dollar as follows: If the market price of Dai is quoted above USD 1, then the Dai Savings Rate is reduced to curb demand for Dai. If the market price of Dai is below USD 1, then the Dai Savings Rate will be increased to increase the demand for Dai.

And how does the Peg Stability Module play into it?

The Peg Stability Module (PSM) smart contract was created to help keep the Dai as fixed as possible at $1. Here’s how it works: The PSM allows users to swap other stablecoins for Dai at a fixed rate at any time to help keep the Dai as close to $1 as possible. For example, users have the option of exchanging 1,000 USDC for 1,000 DAI (minus fees).

Why should I generate my own Dai?

The question is easily answered and the answer is the same as with the classic lombard loan in the old financial world:

- Use Case 1 – Temporary liquidity: The Dai loan helps you to get liquidity when you need money temporarily, but you don’t want to sell your existing positions (e.g., your ETH tokens) because you assume that their value will increase.

- Use case 2 – Leverage: Of course you can also leverage your positions with such a system. For example, imagine that you expect the ETH price to rise. You can now buy ETH, deposit it in the Maker Protocol as collateral to borrow Dai, and use that borrowed Dai to buy more ETH, and then deposit that ETH back into the Maker Protocol to borrow more Dai, which you in turn use to buy ETH , etc.

USER JOURNEY: Generate your own Dai

So, enough explaining and theoretical discussing … now let’s see the protocol in action generate some Dai.

Step 1: There are several user interfaces for the Maker Protocol. Let’s use oasis.app here. So, first open oasis.app in your browser.

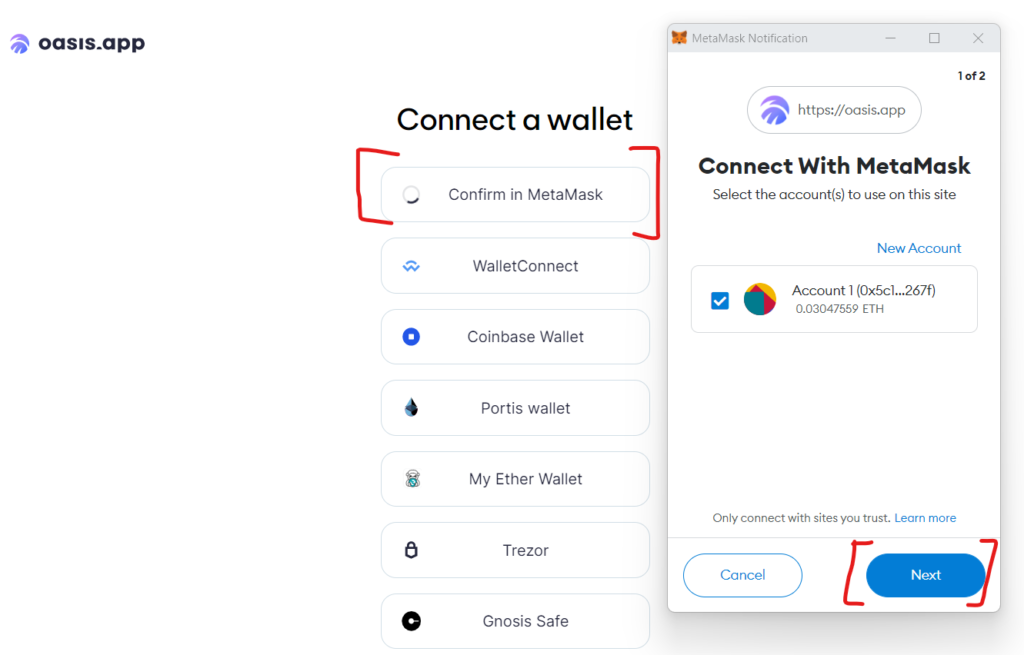

Step 2: As always, you do not log in with your user name and password, but you connect with your wallet. I click Connect a wallet and confirm the connection in my MetaMask wallet.

Step 3: We are now connected with our wallet and click Borrow to start the journey to generate Dai.

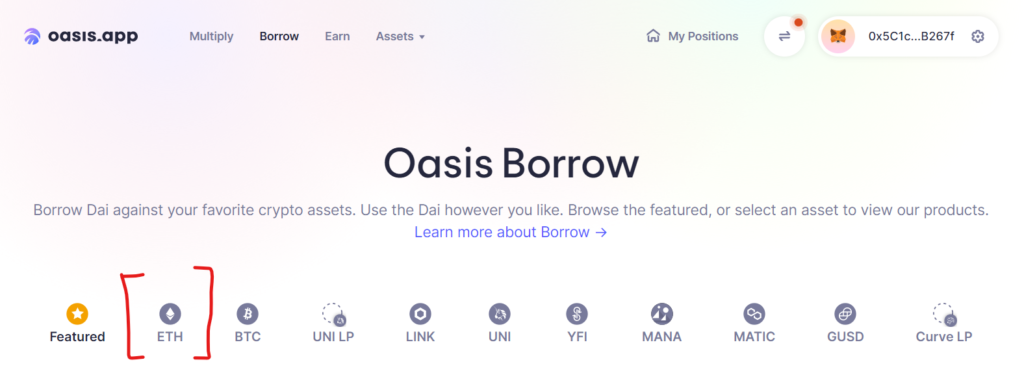

Step 4: Let’s deposit ETH as collateral and hence we click ETH.

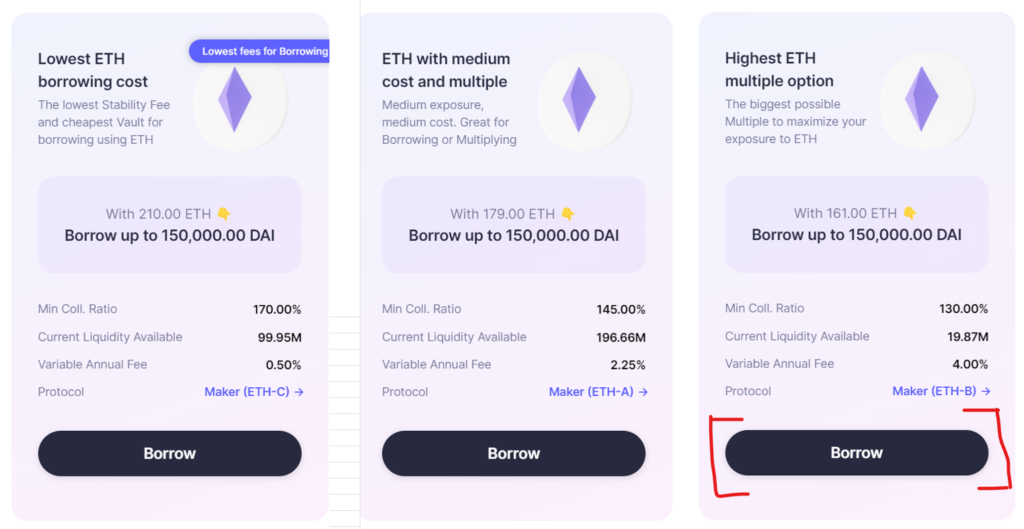

Step 5: We now see that we can choose between three different vault types for ETH. These differ in the minimum collateralization ratio and the fees to be paid for the loan. The following applies: The lower the selected minimum collateralization ratio, the higher the risk for the Maker Protocol and the higher the fees to be paid. We choose the lowest collateralization ratio (130%), which means we have to reckon with 4% fees.

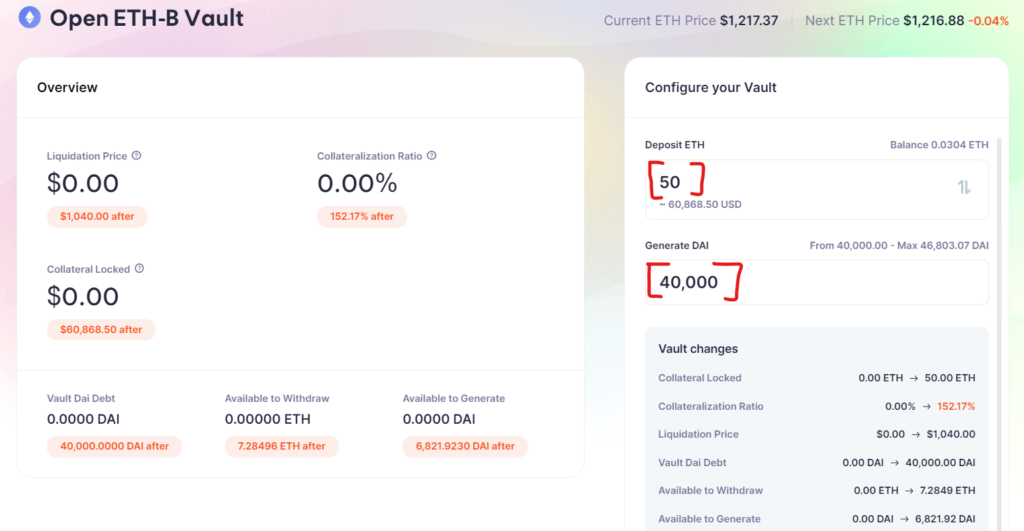

Step 6: Now we can specify our new ETH-backed vault to be created: We deposit 50 ETH in the vault, which currently corresponds to a value of USD 60,868. With a minimum collateralization ratio of 130%, we can create (or borrow) a maximum of 46,803 DAI. In order not to be immediately liquidated at the slightest depreciation of ETH, we only create 40’000 DAI, which corresponds to a collateralization ratio of 152%. We can see in the GUI that the vault created in this way would be liquidated at an ETH price of USD 1,040. I.e., we have a safety buffer between the current price of USD 1’216 and the liquidation price of USD 1’040.

Step 7: As a final step, we create the vault on the Ethereum chain by signing it with our MetaMask wallet. The result is that the 40,000 DAI are created and credited to our wallet.